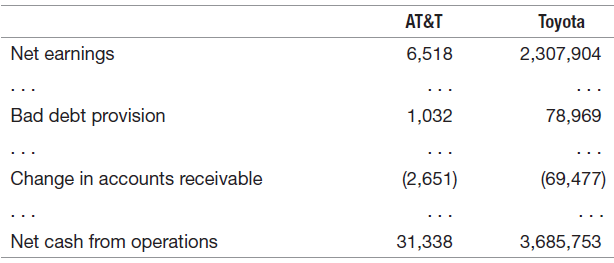

Excerpts from the operating sections of the 2014 statement of cash flows for AT&T and Toyota are

Question:

REQUIRED:

a. What is the bad debt provision, and on which other financial statement would you find it?

b. Explain why the bad debt provision and the change in accounts receivable appear in the operating section of the statement of cash flows.

c. Provide several reasons why net cash from operations is so much larger than net earnings for both companies.

d. Does it look like U.S. GAAP and IFRS account for bad debts much differently? Explain.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: