Following is an excerpt from the 2017 annual report of BHP Billiton. 1. Who is responsible for

Question:

Following is an excerpt from the 2017 annual report of BHP Billiton.

1. Who is responsible for internal control?

2. Why does BHP refer to the US Exchange Act?

3. Why can internal controls provide only reasonable assurance that business risks will be fully mitigated?

Transcribed Image Text:

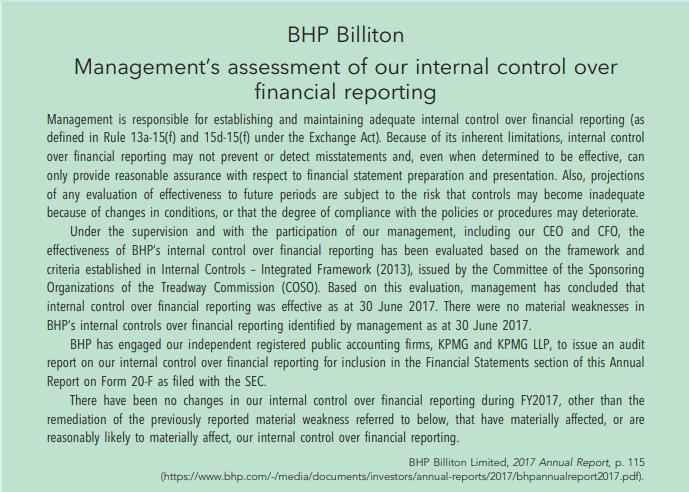

BHP Billiton Management's assessment of our internal control over financial reporting Management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act). Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements and, even when determined to be effective, can only provide reasonable assurance with respect to financial statement preparation and presentation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Under the supervision and with the participation of our management, including our CEO and CFO, the effectiveness of BHP's internal control over financial reporting has been evaluated based on the framework and criteria established in Internal Controls - Integrated Framework (2013), issued by the Committee of the Sponsoring Organizations of the Treadway Commission (COSO). Based on this evaluation, management has concluded that internal control over financial reporting was effective as at 30 June 2017. There were no material weaknesses in BHP's internal controls over financial reporting identified by management as at 30 June 2017. BHP has engaged our independent registered public accounting firms, KPMG and KPMG LLP, to issue an audit report on our internal control over financial reporting for inclusion in the Financial Statements section of this Annual Report on Form 20-F as filed with the SEC. There have been no changes in our internal control over financial reporting during FY2017, other than the remediation of the previously reported material weakness referred to below, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. BHP Billiton Limited, 2017 Annual Report, p. 115 (https://www.bhp.com/-/media/documents/investors/annual-reports/2017/bhpannualreport2017.pdf).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Management is responsible for establishing and maintaining adequate internal control over financial reporting This includes the CEO Chief Executive Of...View the full answer

Answered By

Sayee Sreenivas G B

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson

Question Posted:

Students also viewed these Business questions

-

The following excerpt was taken from Google, Inc.s 10-K report for its 2013 fiscal year: CONTROLS AND PROCEDURES Evaluation of Disclosure Controls and Procedures Our management, with the...

-

The following excerpt was taken from Alphabet, Inc.s 10-K report for its 2017 fiscal year. Alphabet, Inc. is the parent company of Google, Inc. CONTROLS AND PROCEDURES Evaluation of Disclosure...

-

This task is based on the Innovative Widgest Company profile (attached below as Appendix 1,2,3 - Innovative Widgets)- help for this task. Could you please help me with the below task please? This...

-

Find a formula for the function 9(2) as a transformation of the function f(x). -3-2-1 0 x 23 -1 0 1 2 3 4 5 -690 6 -3 -12 g(x) 3 f(x)-1 1 2 -30-214

-

What are some of the simplifying conventions a company can use to calculate depreciation for partial years?

-

Selected data for Faulkner Company for 2005 and additional information on industry averages follow. Required: a. Calculate and compare Faulkner Companys ratios with the industry averages. b. Discuss...

-

5. How do you estimate the potential margin and capital turnover for a young, high-growth company? Are the companys current margin and capital turnover relevant?

-

Consider the McDonalds tracking survey presented in Branding Brief 8-1. What might you do differently? What questions would you change or drop? What questions might you add? How might this tracking...

-

Prepare a report that addresses what the stage three tax cuts are and discuss the policy reasons behind their introduction. In terms of the taxation axioms established by the Asprey Committee in its...

-

Why should the shareholders of a large, publicly traded company want to have the companys financial statements audited?

-

It appears that some top managers attempt to manage their companies financial disclosure, including their financial accounting, to alter the story each disclosure tells. Why might managers be...

-

Calculate by direct integration the moment of inertia for a thin rod of mass M and length L about an axis located distance d from one end. Confirm that your answer agrees with Table 12.2 when d = 0...

-

Write out the form of the partial fraction decomposition of the function (See Example ). Do not determine the numerical values of the coefficients. (If the partial fraction decomposition does not...

-

Below is the actual assignment information. Here is where you will submit your event for approval. It is not graded, but you will need it to be marked complete in order to submit your paper, so...

-

3. (20 points) A researcher is interested in whether the phonics method of teaching reading is more or less effective than the sight method, depending on what grade the child is in. Twenty children...

-

Let A and B be the matrices given below: -5 9 -7 A= 8 -1 -3 B=9 6 -1 8 -1 -7. 0 Perform the following matrix operations and enter the entries below: -4A = A-4B = 5A-3B=

-

The product business can be isolated into four principal classes: programming administrations, framework administrations, open source and SaaS. The accompanying depicts the classifications of...

-

What is your debt payments-to-income ratio if your debt payments total $684 and your net income is $2,000 per month?

-

(a) Prove that form an orthonormal basis for R3 for the usual dot product. (b) Find the coordinates of v = (1, 1, 1)T relative to this basis. (c) Verify formula (5.5) in this particular case. 48-65...

-

The following information is taken from the accounting records of Golden Ltd for the year ended 31 December 2016. Golden Ltd uses a perpetual inventory system. Determine the cost of ending inventory...

-

The following transactions relate to a computer game sold by Wiley Louvres Ltd for the period 1 January to 31 December 2016: 1 Determine the cost of ending inventory as at 31 December 2016 and the...

-

Winedark Sea Ltd sells prints of classic paintings. The prints are done on expensive paper and are quite costly. Pricing the prints to sell is hard because the popularity of a print is difficult to...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App