From the following details, prepare statement showing funds from operating activities using direct method and indirect method.

Question:

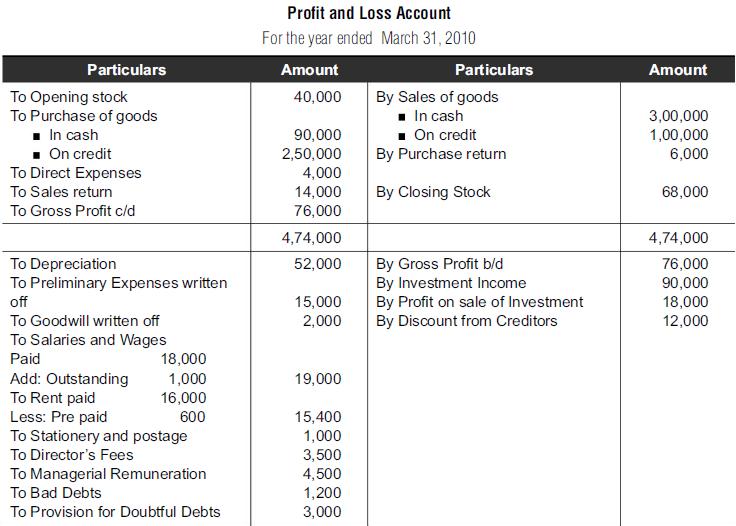

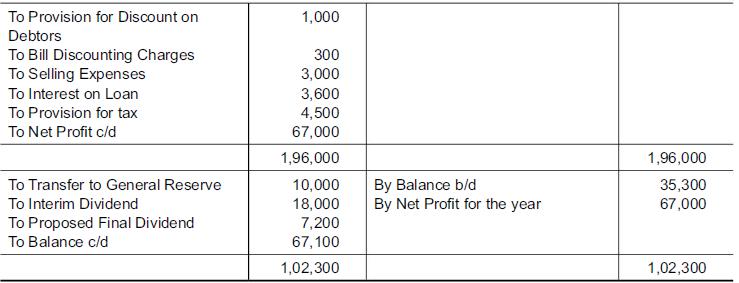

From the following details, prepare statement showing funds from operating activities using direct method and indirect method.

Transcribed Image Text:

Particulars To Opening stock To Purchase of goods ■ In cash ■ On credit To Direct Expenses To Sales return To Gross Profit c/d To Depreciation To Preliminary Expenses written off To Goodwill written off To Salaries and Wages Paid Add: Outstanding To Rent paid 18,000 1,000 16,000 600 Less: Pre paid To Stationery and postage To Director's Fees To Managerial Remuneration To Bad Debts To Provision for Doubtful Debts Profit and Loss Account For the year ended March 31, 2010 Amount 40,000 90,000 2,50,000 4,000 14,000 76,000 4,74,000 52,000 15,000 2,000 19,000 15,400 1,000 3,500 4,500 1,200 3,000 Particulars By Sales of goods In cash ■ On credit By Purchase return By Closing Stock By Gross Profit b/d By Investment Income By Profit on sale of Investment By Discount from Creditors Amount 3,00,000 1,00,000 6,000 68,000 4,74,000 76,000 90,000 18,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Calculation of Funds from Operations Using Direct Method Sale of goods and services Add Discount fro...View the full answer

Answered By

User l_808148

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

From the following details, prepare statement showing cash flow from operating activities using direct method and indirect method: From the following details, prepare cash flow statement and analyse...

-

Need Direct method and Indirect Method for this problem Presented below are the balance sheets of Trout Corporation as of December 31, Year 1 and Year 2, and the income statement for the year ended...

-

Multiple CHOICE Choose the one alternative that best completes the statement or answers the question. 1) One of the purposes of the statement of cash flows is to A) Determine the worth of the...

-

Willingham Company Ltd. has the following comparative statements of financial position data. WILLINGHAM COMPANY LTD. Statements of Financial Position December 31 Additional information for 2017: 1....

-

A wire with a weight per unit length of 0.080 N/m is suspended directly above a second wire. The top wire carries a current of 30.0 A and the bottom wire carries a current of 60.0 A. Find the...

-

Streams carry sediment as well as water. List the following types of sediments in order of deposition: (a) Boulders and cobbles, (b) Pebbles and gravel, (c) Sand, (d) Clays and mud.

-

What challenges can Barrett expect in its export drive? What types of new capabilities does the firm need to acquire to manage its export transactions? LO.1

-

Kimble and Sanchez, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been...

-

Worley Company buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to hundreds of hospitals. Worley sets its prices for all hospitals by marking up its...

-

From the following details, prepare fund flow statement: During the year, a machine costing 20,000 accumulated depreciation on it 13,000 was sold for 15,000. The opening and closing balance,...

-

Sigma International Ltd (SIL) provides the following balance sheet for the year ending March 31, 2009: During the year 200910, the following transactions took place: (i) Cash sales 5,00,000 and...

-

Tennessee Tack manufactures horse blankets. In 2010, fixed overhead was applied to products at the rate of $8 per unit. Variable cost per unit remained constant throughout the year. In July 2010,...

-

Analysis of workforce data, performance, and engagement. Datasets: Employees Table Column Name Data Type Description employee_id Integer Unique identifier for each employee department_id Integer...

-

Discuss your observations of the Data Wrangling process. Does this exercise highlight why data wrangling and preparation can take up 60-70% of the total data analysis process? it does. How do i say...

-

Examine potential implications od regulations, legislation and standards upon decision making in a hospitality organisation, providing specific examples

-

54. .. A baton twirler in a marching band complains that her baton is defective (Figure 9-48). The manufacturer specifies that the baton should have an overall length of L = 60.0cm and a total mass...

-

New United Motor Manufacturing, Inc. was an American automobile manufacturing company in Fremont, California , jointly owned by General Motors and Toyota that opened in 1 9 8 4 and closed in 2 0 1 0...

-

Find a basis for (S), where 1221 1101 1211 1321

-

The cash records of Holly Company show the following four situations. 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash...

-

A fertilizer manufacturing company wants to relocate to Collier County. A 13-year-old report from a fired researcher at the company says the companys product is releasing toxic by-products. The...

-

Indicate whether each of the following is identified with (1) an asset, (2) a liability, or (3) owners equity: a. accounts payable b. cash c. fees earned d. land e. supplies f. wages expense

-

Indicate whether each of the following types of transactions will either (a) increase owners equity or (b) decrease owners equity: 1. Expenses 2. Revenues 3. Owners investments 4. Owners withdrawals

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

Study smarter with the SolutionInn App