Here is the original schedule of cost of goods sold for Talladega Company for the years of

Question:

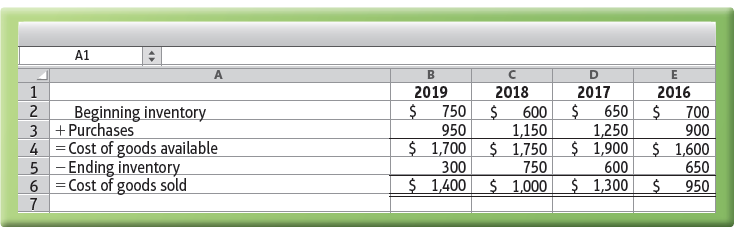

Here is the original schedule of cost of goods sold for Talladega Company for the years of 2016 through 2019:

During the preparation of its 2019 financial statements, Talladega Company discovered that its 2017 ending inventory was understated by $400. Make the correction to the 2017 ending inventory and all other numbers in the schedule of cost of goods sold for any years affected.

1. What is the corrected cost of goods sold for 2017?

2. Did the understatement of ending inventory in 2017 cause the 2017 cost of goods sold to be overstated or understated?

3. What is the corrected cost of goods sold for 2018?

4. Did the understatement of ending inventory in 2017 cause the 2018 cost of goods sold to be overstated or understated?

5. Were any other years impacted by the 2017 $400 understatement of ending inventory? Why or why not?

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.