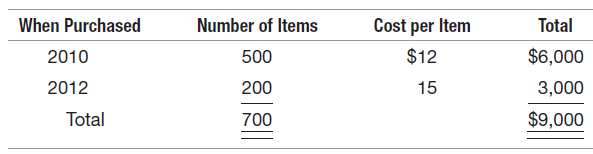

IBT has used the LIFO inventory cost flow assumption for five years. As of December 31, 2016,

Question:

During 2017, IBT sold 900 items for $75 each and purchased 350 items at $30 each. Operating expenses other than cost of goods sold totaled $20,000, and the federal income tax rate was 30 percent of taxable income.

REQUIRED:

a. Prepare IBT€™s income statement for the year ending December 31, 2017.

b. Assume that IBT purchased an additional 550 items on December 20, 2017, for $30 each. Prepare IBT€™s income statement for the year ending December 31, 2017.

c. Compare the two income statements, and discuss why it might have been wise for IBT to purchase the additional items on December 20. Discuss some of the disadvantages of such a strategy.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: