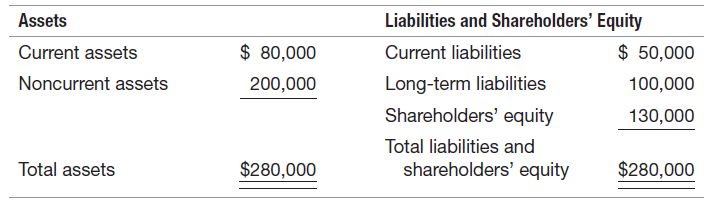

International Services entered into a debt covenant requiring it to maintain a current ratio of at least

Question:

International€™s primary customer is Buckingham Ltd., a company located in Britain. As of December 31, Buckingham owed International 40,000 British pounds. The exchange rate as of December 31 between U.S. dollars and British pounds was $1.70 per pound.

International€™s primary customer is Buckingham Ltd., a company located in Britain. As of December 31, Buckingham owed International 40,000 British pounds. The exchange rate as of December 31 between U.S. dollars and British pounds was $1.70 per pound.

REQUIRED:

a. What dollar amount of International€™s current assets on the balance sheet is associated with the receivable owed by Buckingham?

b. Assume that all account balances remain the same over the next year. Below what exchange rate (U.S. dollar per British pound) would International be in violation of the debt covenant?

c. Assume that $1,700 of accounts payable on the balance sheet represents a debt of 1,000 British pounds to a British bank. Below what exchange rate would International be in violation of the debt covenant now? Consider both the receivable and the payable.

d. Describe how International could hedge to reduce the risk of being in violation of the debt covenant.

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer: