Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2021, Croydon Ltd leased ten excavators for five years from Machines4U Ltd. The excavators are expected to have an economic life

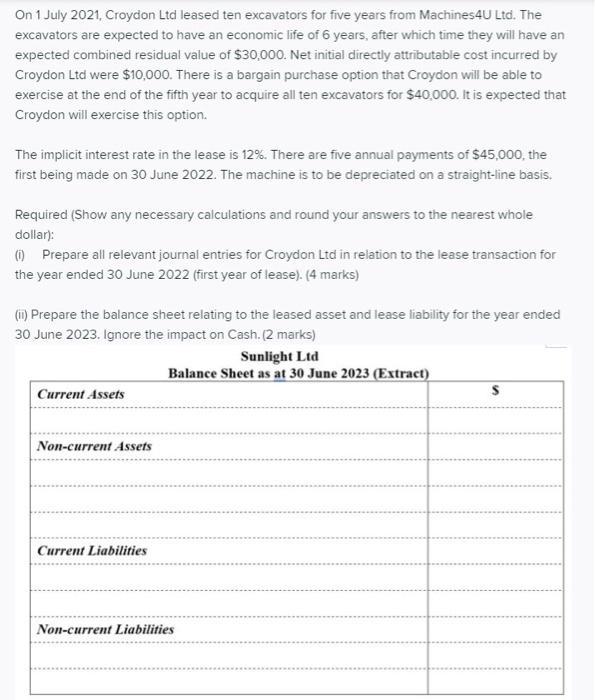

On 1 July 2021, Croydon Ltd leased ten excavators for five years from Machines4U Ltd. The excavators are expected to have an economic life of 6 years, after which time they will have an expected combined residual value of $30,000. Net initial directly attributable cost incurred by Croydon Ltd were $10,000. There is a bargain purchase option that Croydon will be able to exercise at the end of the fifth year to acquire all ten excavators for $40,000. It is expected that Croydon will exercise this option. The implicit interest rate in the lease is 12%. There are five annual payments of $45,000, the first being made on 30 June 2022. The machine is to be depreciated on a straight-line basis. Required (Show any necessary calculations and round your answers to the nearest whole dollar): O Prepare all relevant journal entries for Croydon Ltd in relation to the lease transaction for the year ended 30 June 2022 (first year of lease). (4 marks) (1) Prepare the balance sheet relating to the leased asset and lease liability for the year ended 30 June 2023. Ignore the impact on Cash. (2 marks) Sunlight Ltd Balance Sheet as at 30 June 2023 (Extract) Current Assets Non-current Assets Current Liabilities Non-current Liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i D Working statement D is not correct because whether lease is cancelable or not the present value of minimum lease payments for the purpose of lease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started