It was first year of operations of Milky Enterprises, during the year firm purchased the raw material

Question:

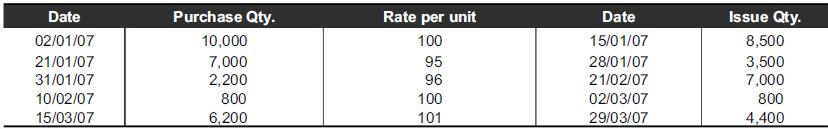

It was first year of operations of Milky Enterprises, during the year firm purchased the raw material several times the records of stores department showed the following records:

Under continuous inventory valuation system, the firm adopted LIFO method of inventory valuation. As a result, the closing inventory for the year ending March 31, 2007 was 2,000 units having cost ₹2,01,800 (market value ₹1,89,7004). After considering these facts and other accounting records, the firm reported a gross profit of ₹12,79,300 for the year ending March 31, 2007 and the net profit for the year was ₹6,64,500.

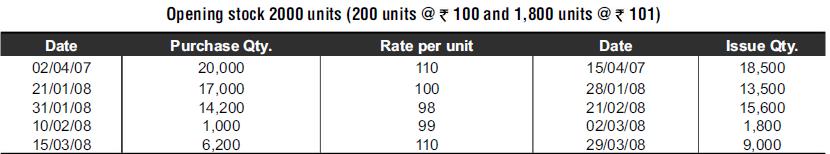

The second year of the firm was more challenging as many new firms had entered in the industry that intensified the level of competition as a result the Milky Enterprises had a tough time in managing its business activities. The records of the stores department showed the following details:

During the year, the accountant of the company was changed as the previous accountant was not fulfilling the requisite qualification. The new accountant adopted the FIFO method under continuous inventory valuation system as a result the closing inventory for the year ending 2008 was 2,000 units valuing ₹2,20,000 (Market value Rs 2,49,0005). The sales activity for the current year was almost of the same level as that of the previous year and the gross profit reported by the firm was ₹12,95,200 and net profit was ₹6,81,200. The chief executive of the firm expressed feeling of satisfaction and relief over the results and motivated the employees to further improve the performance in the next financial year.

Discussion Question

1. Evaluate the accounting policy of the business firm.

2. If you feel that the accounting policy of the firm is not appropriate, then rework the profit using appropriate accounting policy.

Step by Step Answer: