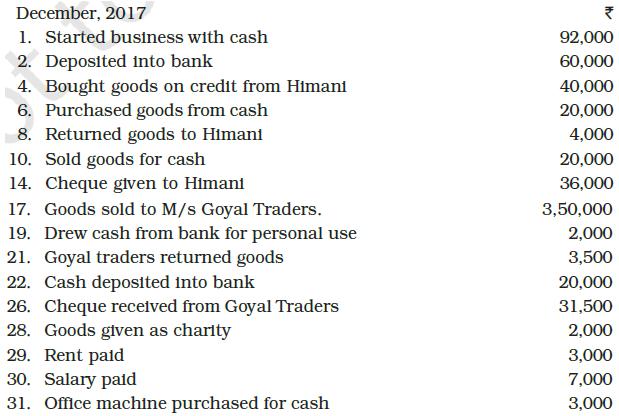

Journalise the following transaction in the Books of the M/s Bhanu Traders and Post them into the

Question:

Journalise the following transaction in the Books of the M/s Bhanu Traders and Post them into the Ledger.

Transcribed Image Text:

December, 2017 1. Started business with cash 2. Deposited into bank 4. Bought goods on credit from Himani 6. Purchased goods from cash 8. Returned goods to Himani 10. Sold goods for cash 14. Cheque given to Himani 17. Goods sold to M/s Goyal Traders. 19. Drew cash from bank for personal use 21. Goyal traders returned goods 22. Cash deposited into bank 26. Cheque received from Goyal Traders 28. Goods given as charity 29. Rent paid 30. Salary paid 31. Office machine purchased for cash ₹ 92,000 60,000 40,000 20,000 4,000 20,000 36,000 3,50,000 2,000 3,500 20,000 31,500 2,000 3,000 7,000 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

Lets journalize the given transactions for Ms Bhanu Traders in December 2017 and then post them into the ledger Journal Entries December 1 2017 Cash A...View the full answer

Answered By

User l_917591

As a Business Management graduate from Moi University, I had the opportunity to work as a tutor for undergraduate students in the same field. This experience allowed me to apply the theoretical knowledge I had gained in a practical setting, while also honing my teaching and communication skills.

As a tutor, I was responsible for conducting tutorial sessions, grading assignments and exams, and providing feedback and support to my students. I also assisted with the preparation of course materials and collaborated with other tutors and professors to ensure consistency in teaching and assessment.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accountancy Financial Accounting Part 1 Textbook For Class 11

ISBN: 9788174505071

1st Edition

Authors: NCERT

Question Posted:

Students also viewed these Business questions

-

Journalise the following transactions and post them into ledger account & prepare trial balance . 2020 march 1, started business with cash 150000, machinery worth 200000 and building 350000 . 5,...

-

Journalise the following transaction in the books of Sanjana and post them into the ledger : January, 2017 1. Cash in hand Cash at bank Stock of goods Due to Rohan Due from Tarun 3. Sold goods to...

-

1 g mole of a compoind consist of A) One molecule of the compound B) On atom of the compound C) 6.023*10^23 molecules D) 22.4*10^2 molecules

-

Ned and Nelly Norbert, both aged 35, have three small children. Nancy aged 10, Nadia aged 8, and Nadine aged 3. The Norberts want to ensure that they have adequate resources in place to complete...

-

At December 31, 2010, Albrecht Corporation had outstanding 373,000 shares of common stock and 8,000 shares of 9.5%, $100 par value cumulative, nonconvertible preferred stock. On May 31, 2011,...

-

After preparing a flowchart of a local government's procurement system, an auditor should next: a. Select a random sample of transactions to audit. b. Identify the control points. c. Prepare a report...

-

For Washburn, what are examples of (a) shifting the demand curve to the right to get a higher price for a guitar line (movement of the demand curve) and (b) pricing decisions involving moving along a...

-

What will be the nominal rate of return on a preferred stock with a $100 par value, a stated dividend of 8 percent of par, and a current market price of? (a) $60, (b) $80, (c) $100, and (d) $140?

-

Consider the following statements: L. Residual income facilitates goal congruence. II. One benefit of residual income is that it can be used to compare the performance of different sized investment...

-

Journalise the following transaction in the Book of M/s Beauti traders. Also post them in the ledger. Dec. 2017 1. Started business with cash 2. Bought office furniture 3. Paid into bank to open an...

-

Give journal entries of M/s Mohit traders, Post them to the Ledger from the following transactions : August 2017 1. Commenced business with cash 2. 3. 7. 8. 10. 14. 16. 18. 20. 22. 23. 25. 30. Opened...

-

In Exercises determine whether the sequence with the given nth term is monotonic and whether it is bounded. Use a graphing utility to confirm your results. = sin an n 6

-

Dr. Powers operates a single-provider family medical practice. One medical assistant handles appointments, basic bookkeeping functions, and assists with medical records. Two additional medical...

-

Quiz 6 Fall 2019 - MGCR-211-001/002/003 edugen.wileyplus.com WileyPLUS Financial Accounting, Seventh Canadian Edition by Kimmel, Weygandt, Kieso, Trenholm, Irvine, and Burnley Help | System...

-

In Exercises 21-24, use these results from the "1-Panel-THC" test for marijuana use, which is provided by the company Drug Test Success: Among 143 subjects with positive test results, there are 24...

-

4 Listen Using the DCF approach yields the value of the company as a whole. How would one refine this to determine the value of a share of stock? 1) Divide the company value by total assets. 2)...

-

The "is" or "is not" test established in McPhail v. Doulton (1971) for discretionary trusts creates more problems than it resolves.' Critically evaluate this statement. requirement Table of content...

-

Refer to the data in Problem 5-4B. In Problem 5-4B. Feenie Produce Company's trial balance below pertains to December 31, 2014. Feenie Produce Company uses the perpetual inventory system. Additional...

-

Find the cross product a x b and verify that it is orthogonal to both a and b. a = (t, 1, 1/t), b = (t 2 , t 2 , 1)

-

What are closing entries? Give four examples of closing entries.

-

What are financial statements? What information do they provide.

-

What is an operating profit?

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App