Marvins Foods has outstanding 400 shares of 2% preferred stock, $100 par value; and 1,500 shares of

Question:

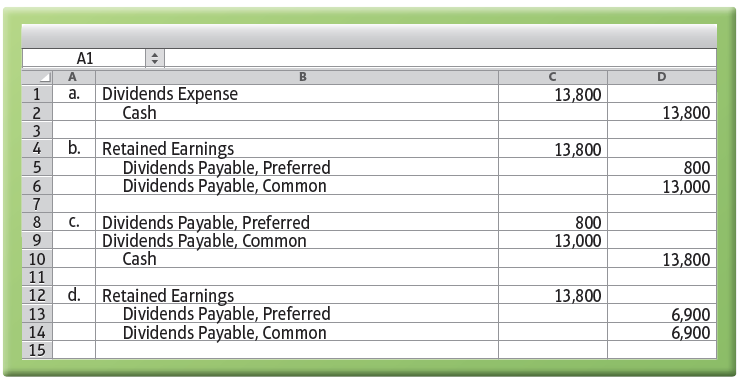

Marvin’s Foods has outstanding 400 shares of 2% preferred stock, $100 par value; and 1,500 shares of common stock, $15 par value. Marvin’s declares dividends of $13,800. Which of the following is the correct entry?

Transcribed Image Text:

A1 Dividends Expense Cash 13,800 a. 13,800 3 b. Retained Earnings 13,800 Dividends Payable, Preferred Dividends Payable, Common 800 13,000 Dividends Payable, Preferred Dividends Payable, Common Cash C. 800 13,000 9. 10 11 13,800 d. Retained Earnings 12 13,800 Dividends Payable, Preferred Dividends Payable, Common 6,900 6,900 13 14 15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

b b Retained Earni...View the full answer

Answered By

Akshay Agarwal

I am a Post-Graduate with a specialization in Finance. I have been working in the Consulting industry for the past 8 years with a focus on the Corporate and Investment Banking domain. Additionally, I have been involved in supporting student across the globe in their academic assignments and always strive to provide high quality support in a timely manner. My notable achievements in the academic field includes serving more than 10,000 clients across geographies on various courses including Accountancy, Finance, Management among other subjects. I always strive to serve my clients in the best possible way ensuring high quality and well explained solutions, which ensures high grades for the students along-with ensuring complete understanding of the subject matter for them. Further, I also believe in making myself available to the students for any follow-ups and ensures complete support and cooperation throughout the project cycle. My passion in the academic field coupled with my educational qualification and industry experience has proved to be instrumental in my success and has helped me stand out of the rest. Looking forward to have a fruitful experience and a cordial working relationship.

5.00+

179+ Reviews

294+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

Calliope Corp. has outstanding 400 shares of common stock of which Yak, So, Day, and Ren each own 100 shares, or 25%. No stock is considered constructively owned by any of the shareholders under ...

-

Multiple Choice Questions 1. Lucas Foods has outstanding 600 shares of 7% preferred stock, $100 par value, and 1,600 shares of common stock , $30 par value. Lucas declares dividends of $15,800. The...

-

(Multiple-Choice) 1. Which of the following is a characteristic of a corporation? a. No income tax b. Mutual agency c. Limited liability of stockholders d. Both a and b 2. Home Team, Inc., issues...

-

A rectangular loop of wire 24 cm by 72 cm is bent into an L shape, as shown in FIGURE 23-49. The magnetic field in the vicinity of the loop has a magnitude of 0.035 T and points in a direction...

-

Let S be the standard basis for Rn. Prove Theorem 8.6.2 by showing that the linear transformation T: V Rn that maps v V to its coordinate vector (v)s in Rn is an isomorphism.

-

For the following telescoping series, find a formula for the nth term of the sequence of partial sums {S n }. Then evaluate to obtain the value of the series or state that the series diverges. lim S...

-

Summarize factor proportions theory. What factors are most abundant in China, Japan, Germany, Saudi Arabia, and the United States? Visit globalEDGE for helpful information..L01

-

Manzer Enterprises produces premier raspberry jam. Output is measured in pints. Manzer uses the weighted average method. During January, Manzer had the following production data: Units in process,...

-

Wayne Enterprise is analyzing a project with projected cash inflows of $190,000, $210,000, and -$18,000 for years 1 to 3, respectively. The project costs $300,000 and has been assigned a discount...

-

The consequence variable used in the House-Hunting example was Net Annual Cost, but as we mentioned, houses are also purchased as investments, suggesting that it might be useful to include equity and...

-

Stockholders are eligible for a dividend if they own the stock on the date of a. Declaration. b. Record. c. Payment. d. Issuance.

-

A corporation has 100,000 shares of 4% preferred stock outstanding. Also, there are 100,000 shares of common stock outstanding. Par value for each is $100. If a $825,000 dividend is paid, how much...

-

A unity negative feedback system has the loop transfer function Determine the closed-loop system bandwidth. Using the bode function obtain the Bode plot and label the plot with the bandwidth....

-

What is the formula for Bouley's coefficient of skewness?

-

What is the relation between orthocentre,circumcentre and centroid of a triangle?

-

When do we use Fourier transforms and Laplace transforms in RC/RL/RLC circuit analysis?

-

What are the protocols used in a drone?

-

How do we design a drone?

-

How do concentration polarization and kinetic polarization resemble one another? How do they differ?

-

How can NAFTA be beneficial to suppliers of Walmart?

-

Using the income statement for Dynasty Travel Service shown in Practice Exercise 1-1A, prepare a retained earnings statement for the current year ended June 30, 2012. Nancy Coleman, the owner,...

-

Using the income statement for Escape Travel Service shown in Practice Exercise 1-4B, prepare a retained earnings statement for the current year ended November 30, 2012. Brett Daniels, the owner,...

-

a. A vacant lot acquired for $100,000 is sold for $350,000 in cash. What is the effect of the sale on the total amount of the sellers (a) assets, (2) liabilities, and (3) stockholders equity...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

Workbook For The Creative Act A Guide To Rick Rubins Book 1st Edition - ISBN: B0C87VC7JN - Free Book

Study smarter with the SolutionInn App