Murray Company is developing its annual financial statements at December 31, current year. The statements are complete

Question:

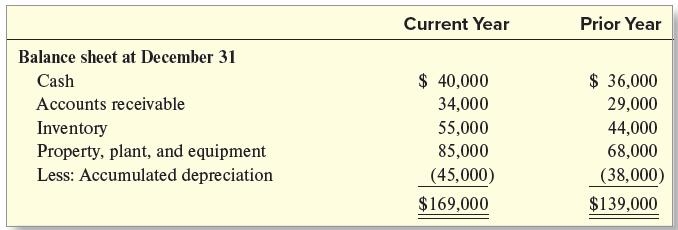

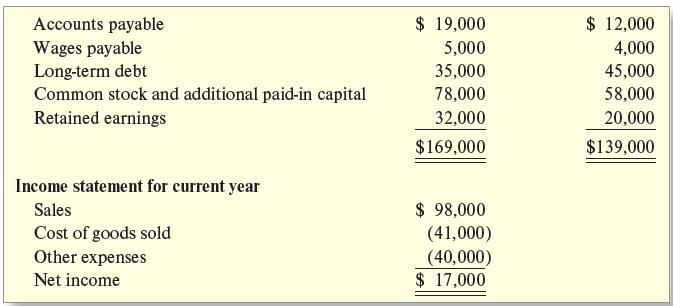

Murray Company is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows:

Additional Data:

a. Bought fixed assets for cash, $17,000.

b. Paid $10,000 of principal on the long-term note payable.

c. Sold unissued common stock for $20,000 cash.

d. Declared and paid a $5,000 cash dividend.

e. Incurred the following expenses: depreciation, $7,000; wages, $18,000; taxes, $4,000; and other, $11,000.

Required:

1. Prepare the statement of cash flows T-accounts using the indirect method to report cash flows from operating activities.

2. Prepare the statement of cash flows.

3. Prepare a schedule of noncash investing and financing activities if necessary.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge