Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the month, the company

Question:

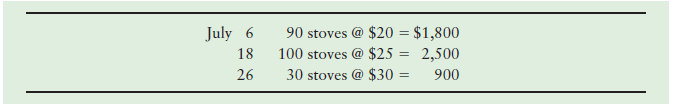

Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the month, the company made the following purchases at cost:

The company sold 250 stoves, and at July 31, the ending inventory consisted of 50 stoves. The sales price of each stove was $52.

Requirements

1. Determine the cost of goods sold and ending inventory amounts for July under the averagecost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar.

2. Explain why cost of goods sold is highest under LIFO. Be specific.

3. Prepare the Navy Surplus income statement for July. Report gross profit. Operating expenses totaled $3,250. The company uses average costing for inventory. The income tax rate is 40%.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.