On 1 July 2021 Peet Ltd purchased 40 per cent of the ordinary shares of Keet Ltd

Question:

On 1 July 2021 Peet Ltd purchased 40 per cent of the ordinary shares of Keet Ltd for $3 250 000. The remaining 60 per cent of the ordinary shares of Keet Ltd are owned by two shareholders, Radio Ltd, which owns 40 per cent of the shares, and Birdman Unit Trust, which owns 20 per cent of the shares.

Keet Ltd’s constitution provides that at general meetings of the company ordinary shareholders are entitled to vote on resolutions and elect directors on the basis of one vote per ordinary share. Keet Ltd’s five-member board of directors consists of:

Two representatives of Peet Ltd

Two representatives of Radio Ltd

One representative of Birdman Unit Trust.

Each member of Keet Ltd’s board of directors is entitled to one vote on issues/resolutions being considered by the board of directors.

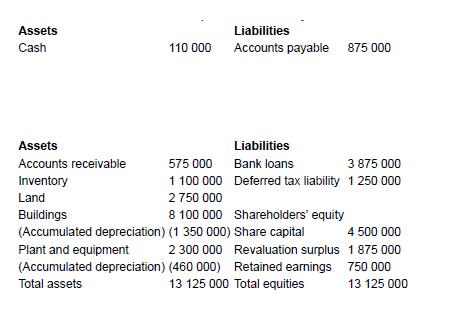

The statement of financial position of Keet Ltd immediately before the investment was as follows: Keet Ltd Statement of financial position as at 1 July 2021.

Additional information

- On 1 July 2021, all of the identifiable net assets of Keet Ltd were considered to be recorded at fair value in Keet Ltd’s statement of financial position, except land, which had a fair value of $3 375 000 on 1 July 2021.

- On 30 June 2022, the recoverable amount of goodwill acquired in Keet Ltd by Peet Ltd was assessed to be $225 000.

- On 14 July 2021, Keet Ltd declared and paid an interim dividend of $200 000, out of profits earned during the 2020–21 financial year.

- During 2021–22, Keet Ltd earned a profit after income tax expense of $725 000, from which it paid a final dividend of $325 000.

- During 2022–23, Keet Ltd earned a profit after income tax expense of $850 000, from which it declared a final dividend of $400 000.

- On 30 June 2023, Keet Ltd revalued its land (to fair value as at that date) to $3 625 000.

- The income tax rate is 40 per cent.

REQUIRED

a. Explain how Peet Ltd should classify its investment in Keet Ltd, in accordance with accounting standards.

b. Prepare the journal entries to account for Peet Ltd’s investment in Keet Ltd, in Peet Ltd’s individual accounts, for the financial years ending 30 June 2022 and 30 June 2023, in accordance with AASB 128, assuming that Peet Ltd is a parent entity.

c. Prepare the journal entries to account for Peet Ltd’s investment in Keet Ltd, in Peet Ltd’s individual accounts, for the financial years ending 30 June 2022 and 30 June 2023, in accordance with AASB 128, assuming that Peet Ltd is not a parent entity.

d. Prepare the consolidation worksheet journal entries to account for Peet Ltd’s investment in Keet Ltd, for the financial years ending 30 June 2022 and 30 June 2023, in accordance with AASB 128, assuming that Peet Ltd is a parent entity.

Step by Step Answer: