On January 1 of this year, Diego Corporation sold bonds with a face value of $500,000 and

Question:

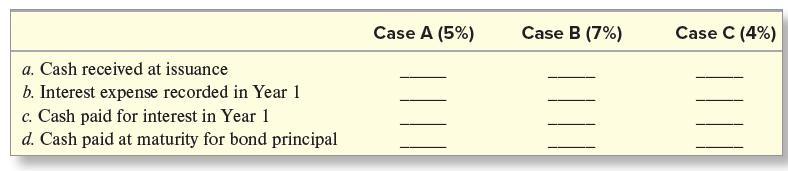

On January 1 of this year, Diego Corporation sold bonds with a face value of $500,000 and a coupon rate of 5 percent. The bonds mature in 10 years and pay interest annually on December 31. Diego uses the effective-interest amortization method. Ignore any tax effects. Each case is independent of the other cases.

Required:

Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued.

Transcribed Image Text:

a. Cash received at issuance b. Interest expense recorded in Year 1 c. Cash paid for interest in Year 1 d. Cash paid at maturity for bond principal Case A (5%) Case B (7%) Case C (4%)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

CASE A Market interest rate 5 a Cash received at issuance 500000 x 005 Using Exc...View the full answer

Answered By

Rashul Chutani

I have been associated with the area of Computer Science for long. At my university, I have taught students various Computer Science Courses like Data Structures, Algorithms, Theory of Computation, Digital Logic, System Design, and Machine Learning. I also write answers to questions posted by students in the area of and around Computer Science.

I am highly fortunate to receive great feedback on my teaching skills that keeps me motivated. Once a student sent me an email stating that I had explained to him a concept better than his professor did.

I believe in the fact that "Teaching is the best way to learn". I am highly fascinated by the way technology nowadays is solving real-world problems and try to contribute my bit to the same.

Besides tutoring, I am a researcher at the Indian Institute of Technology. My present works are in the area of Text Summarization and Signal and Systems.

Some of my achievements include clearing JEE Advanced with an All India Rank of 306 out of 1.5 million contesting candidates and being the Department Ranker 1 at my University in the Department of Computer Science and Engineering.

I look forward to providing the best Tutoring Experience I can, to the student I teach.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge

Question Posted:

Students also viewed these Business questions

-

On January 1 of this year, Reeks Wholesale Meats had a credit balance of $ 4,234 in Allowance for Doubtful Accounts. During the year, the company completed the following selected transactions: Feb. 8...

-

The company intends to issue 20-year bonds with a face value of $1,000. The bonds carry a coupon rate of 10%, and interest is paid semiannually. On the issue date, the market interest rate for bonds...

-

On January 1 of this year. Clearwater Corporation sold bonds with a face value of $750,000 and a coupon rate of 8 percent. The bonds mature in 10 years and pay interest annually every December 31....

-

Northland Corporation is a small information-systems consulting firm that specializes in helping companies implement standard sales-management software. The market for Northalndss services is very...

-

The study Digital Footprints (Pew Internet & American Life Project, www. pewinternet. org, 2007) reported that 47% of Internet users have searched for information about themselves online. The 47%...

-

?I think we goofed when we hired that new assistant controller,? said Ruth Scarpino, president of Provost Industries. ?Just look at this production report that he prepared for last month for the...

-

1. How should Jennifer go about making her decision?

-

Jerry Stevenson is the manager of a medical clinic in Scottsdale, AZ. He wants to analyze patient data to identify high-risk patients for cardiovascular diseases. From medical literature, he learned...

-

Please help me answer this with only one paragraph per question I PROMISE THUMBS UP FOR YOU 1. Explain and provide an example of Confirmation in audit! 2. Explain the possibilities for lowering Audit...

-

The vortex tube (also known as a Ranque or Hirsch tube) is a device that produces a refrigeration effect by expanding pressurized gas such as air in a tube (instead of a turbine as in the reversed...

-

What is the difference between an unsecured and a secured bond?

-

You are a personal financial planner working with a married couple in their early 40s who have decided to invest $100,000 in corporate bonds. You have found two bonds that you think will interest...

-

How are each of the following financial statements interrelated? (a) Retained earnings statement and in- come statement. (b) Retained earnings statement and balance sheet. (c) Balance sheet and...

-

Saskatchewan Soy Products (SSP) buys soy beans and processes them into other soy products. Each tonne of soy beans that SSP purchases for $300 can be converted for an additional $200 into 500 lbs of...

-

Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510...

-

Company panther is compelled to pick between two machines An and B. The two machines are planned in an unexpected way, yet have indistinguishable limit and do the very same work. Machine A costs...

-

On April 30, 2023, a company issued $600,000 worth of 5% bonds at par. The term of the bonds is 9 years, with interest payable semi- annually on October 31 and April 30. The year-end of the company...

-

Identify the following; MethodBodyReturn statementReturn typeParameter Look at this example we saw in our Methods lesson: public double findTheArea (double length, double w idth) { double area =...

-

What do you think are the concerns for the company regarding Toms facial hair? Should they care about his appearance?

-

How does Kant answer Humes bundle theory of self? Do you think he is successful?

-

Presented below are the financial statements of Helwany Company. Additional data:1. Depreciation expense was $17,500.2. Dividends declared and paid were $20,000.3. During the year equipment was sold...

-

Data for Helwany Company are presented in P12-7A. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were...

-

Condensed financial data of Lemere Inc. follow. Additional information:1. New plant assets costing $100,000 were purchased for cash during the year.2. Old plant assets having an original cost of...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

-

The rate of return on Cherry Jalopies, Inc., stock over the last five years was 14 percent, 11 percent, 4 percent, 3 percent, and 7 percent. What is the geometric return for Cherry Jalopies, Inc.?

-

U.S. GAAP specifies all of the following characteristics of variable interest entities except: A. Equity holders hold less than 5% of the entitys voting stock. B. Equity holders do not have voting...

Study smarter with the SolutionInn App