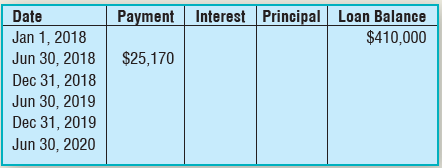

Orbit Corp. issued a $410,000, 9 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1.

Question:

Orbit Corp. issued a $410,000, 9 percent mortgage on January 1, 2018, to purchase warehouses.

Requirements

1. Complete the amortization schedule for Orbit Corp., assuming payments are made semiannually. Round amounts to the nearest dollar.

2. Record the journal entries for (a) issuance of the mortgage on January 1, 2018, and (b) the first semiannual payment on June 30, 2018.

Date Jan 1, 2018 Jun 30, 2018 Dec 31, 2018 Jun 30, 2019 Dec 31, 2019 Jun 30, 2020 Payment Interest Principal Loan Balance $410,000 $25,170

Step by Step Answer:

Req 1 A B C D Date Payment Interest D x 9 x 612 PrincipalA ...View the full answer

Related Video

An amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period

Students also viewed these Business questions

-

Ling Company issued a $280,000, 4 percent mortgage on January 1, 2016, to purchase a building. Payments of $8,055 are made semiannually. Complete the following amortization schedule (partial) for...

-

McCormack Co., purchased a building and issued a $360,000, 6 percent mortgage on January 1, 2016. Payments of $13,008 are made semiannually on June 30 and December 31 each year. Record the journal...

-

Orbit Corp., issued a $410,000, 9 percent, mortgage on January 1, 2016, to purchase warehouses. Requirements 1. Complete the amortization schedule for Orbit, Corp., assuming payments are made...

-

There are three general methods of allocating overhead costs: plantwide rates, rates for each expense category, and departmental rates. Describe when each is the most useful.

-

Explain why you cannot directly adapt the proof that there are infinitely many primes (Theorem 3 in Section 4.3) to show that are infinitely many primes in the arithmetic progression 4k + 1, k = 1,...

-

What is personality? What are cultural values? What is ability? LO9

-

(Appendix 10B) Why do companies use accelerated methods to depreciate their fixed assets for tax purposes? How does this practice lead to the recognition of a liability?

-

What are the pros, cons, and risks associated with Nikes core marketing strategy?

-

9. Thomas borrows $7,500 at 10% per year compounded annually and will repay the loan in 3 equal annual payments starting 1 year after the loan is made. a. What is the size of his annual payment? b....

-

Match the following and select the correct option. Height of Binary search tree(in worst o([log ]-1) 1 a (2n+1) case) Height of Ternary tree b O(n) Height of B-tree(when c minimum degree, -2) (log,...

-

At December 31, 2018, Salish Hardware owes $4,800 on accounts payable, plus salaries payable of $5,300 and income tax payable of $6,100. Salish Hardware also has $320,000 of notes payable that...

-

Adirondack Publishing Company completed the following transactions during 2018: Aug 1 Sold 30 six-month subscriptions, collecting cash of $1,500, plus sales tax of 7%. Sep 15 Remitted the sales tax...

-

Byron Books Inc. recently reported $13 million of net income. Its EBIT was $20.8 million, and its tax rate was 35%. What was its interest expense?

-

3 4pts Foam k MA C L H W F A box is transported by a truck. Suddenly, the driver uses the brakes and applies 100 N deceleration force to the box. The weight of the box is 20 Kg and its dimensions are...

-

FA II: Assignment 1 - COGS & Bank Reconciliation 1. The following data pertains to Home Office Company for the year ended December 31, 2020: Sales (25% were cash sales) during the year Cost of goods...

-

Bramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Made Bramble credit card sales totaling...

-

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the...

-

Karak Company produces Product (A) for only domestic distribution since year 2017. In 2019, a similar product to Karak Company has come onto the market by another competitor. Karak Company is keen to...

-

Does a resulting trust carry out the wishes of the settlor? Why or why not?

-

Borrowing costs should be recognised as an expense and charged to the profit and loss account of the period in which they are incurred : A. If the borrowing costs relate to qualifying asset B. If the...

-

Identify each of the following assets as a fixed asset (F) or an intangible asset (I): _____ 1. Franchises _____ 2. Vehicles _____ 3. Buildings _____ 4. Furniture _____ 5. Patents _____ 6. Copyrights...

-

For each of the following long-term assets, identify the type of expense that will beincurred to allocate the assets cost as depreciation expense (DR), depletion expense (DL), amortization expense...

-

Identify each of the following as land (L) or land improvements (LI): _____ 1. Survey fees _____ 2. Fencing _____ 3. Lighting _____ 4. Clearing land _____ 5. Parking lot

-

A donor wishes to endow a scholarship to a certain university in the name of a certain professor. The scholarship is to provide $60,000 per year for first 5 years and $110,000 per year for the...

-

You purchase a home for $220.000 and sell it 25 years later for $600,000. If inflation averaged 2% per year over the 25 years, then what was your average annual real rate of return on the real estate...

-

P8-5 (similar to) Question Help (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when...

Study smarter with the SolutionInn App