Orlando Medicals current ratio at year-end 2018 is closest to a. $735. b. $8,578. c. 0.94. d.

Question:

Orlando Medical’s current ratio at year-end 2018 is closest to

a. $735.

b. $8,578.

c. 0.94.

d. 1.2.

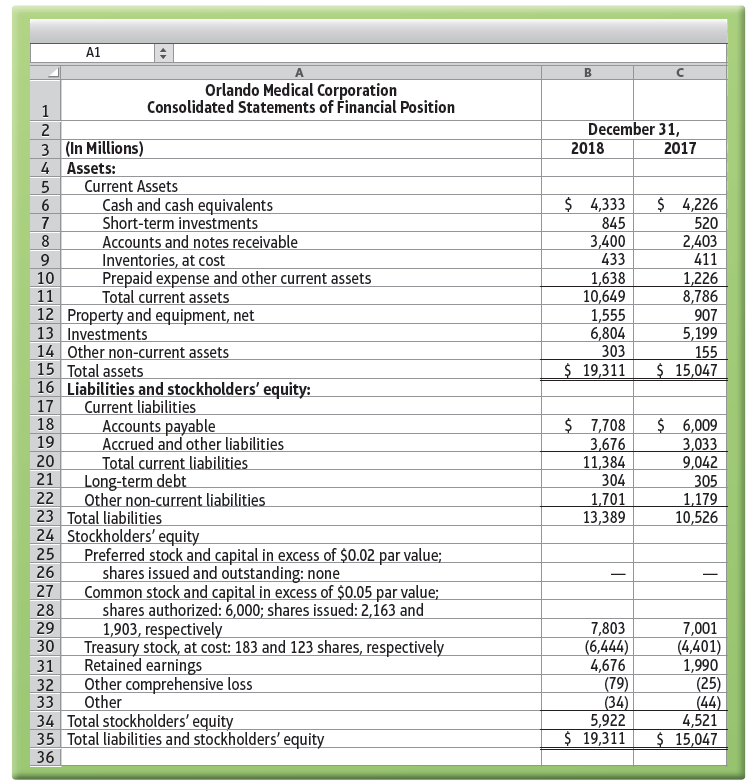

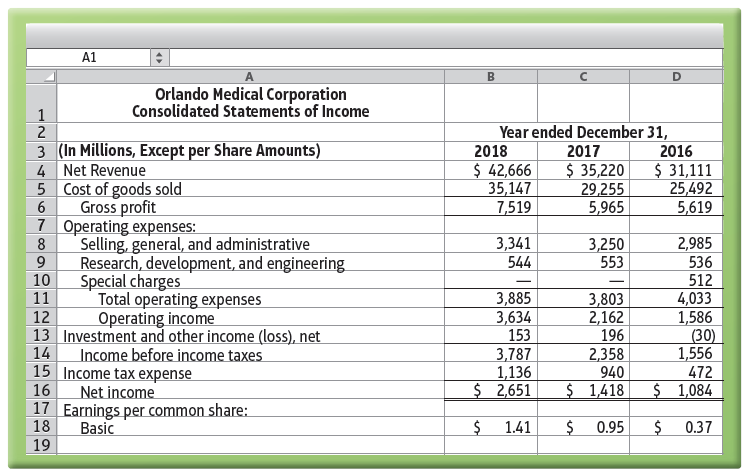

Use the Orlando Medical Corporation financial statements that follow to answer this question.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

A1 Orlando Medical Corporation Consolidated Statements of Financial Position December 31, 2018 2 3 (In Millions) 4 Assets: 2017 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable Inventories, at cost $ 4,333 845 3,400 433 $ 4,226 520 2,403 411 8 Prepaid expense and other current assets 10 11 1,638 10,649 1,555 6,804 303 $ 19,311 1,226 8,786 907 Total current assets 12 Property and equipment, net 13 Investments 5,199 155 $ 15,047 14 Other non-current assets 15 Total assets 16 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued and other liabilities Total current liabilities 17 18 19 $ 7,708 3,676 11,384 304 1,701 13,389 $ 6,009 3,033 9,042 305 1,179 10,526 20 21 Long-term debt Other non-current liabilities 22 23 Total liabilities 24 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; 25 shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively 26 27 28 29 7,803 (6,444) 4,676 (79) (34) 5,922 $ 19,311 7,001 (4,401) 1,990 (25) (44) 4,521 $ 15,047 30 Retained earnings 31 Other comprehensive loss 32 Other 34 Total stockholders' equity 35 Total liabilities and stockholders' equity 33 36 A1 Orlando Medical Corporation Consolidated Statements of Income Year ended December 31, 2018 3 (In Millions, Except per Share Amounts) 4 Net Revenue 5 Cost of goods sold Gross profit 7 Operating expenses: Selling, general, and administrative Research, development, and engineering 10 2017 2016 $ 42,666 35,147 7,519 $ 35,220 29,255 5,965 $ 31,111 25,492 5,619 6 3,341 544 3,250 553 2,985 536 Special charges 512 4,033 1,586 (30) 1,556 472 $ 1,084 11 Total operating expenses 3,885 3,634 153 3,803 2,162 196 12 Operating income 13 Investment and other income (loss), net 14 Income before income taxes 15 Income tax expense 16 3,787 1,136 $ 2,651 2,358 940 $ 1,418 Net income 17 Earnings per common share: 18 Basic 19 1.41 0.95 0.37

Step by Step Answer:

c 106...View the full answer

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

Multiple Choice Questions Use the Hialeah Bell Corporation financial statements that follow to answer questions 1 through 6. 1. During 2010, Hialeah Bells total assets a. Increased by $9,390 million....

-

Orlando Medicals common-size income statement for 2018 would report cost of goods sold as a. 82.4%. b. $35,147 million. c. up by 20.1%. d. 137.9%. Use the Orlando Medical Corporation financial...

-

(Multiple choice) Use the Buffalo Bell Corporation financial statements that follow to answer questions 1 through 6. 1. During 2012, Buffalo Bells total assets a. increased by 28.3%. b. increased by...

-

Education is a very important job because it can change and shape people's lives. It gives people the knowledge, skills, and attitudes they need to be successful in their personal and work lives. As...

-

Are there values of r and s for which 02+3 1 2 0 1000

-

It was wartime when the Ricardos found out Mrs. Ricardo was pregnant. Ricky Ricardo was drafted and made out a will, deciding that $14,000 in a savings account was to be divided between his wife and...

-

If the assets are $2,000,000 and liabilities are $1,600,000, what is the owners equity? LO.1

-

On January 1, 2015, Corvallis Carnivals borrows $30,000 to purchase a delivery truck by agreeing to a 5%, five-year loan with the bank. Payments of $566.14 are due at the end of each month, with the...

-

An analyst makes the following assumptions: Sales = $100; Total Assets Turnover Ratio = 1; Debt/Equity = 1. What should be the value of equity?

-

Male koalas bellow during the breeding season, but do females pay attention? Charlton et al. (2012) measured responses of estrous female koalas to playbacks of bellows that had been modified on the...

-

During 2018, Orlando Medicals total assets a. increased by $1,863 million. b. increased by 28.3%. c. Both a and b. d. increased by 22.1%. Use the Orlando Medical Corporation financial statements that...

-

Orlando Medicals quick (acid-test) ratio at year-end 2018 is closest to a. 0.68. b. $8,578 million. c. 0.45. d. 0.75. Use the Orlando Medical Corporation financial statements that follow to answer...

-

What is the recoverable amount of an asset?

-

Figure < 4 ft/s 45 0.75 ft 3 ft/s 1.50 ft 1 of 1 < Part A Determine the velocity of point A on the rim of the gear at the instant shown.(Figure 1) Enter the x and y components of the velocity...

-

what ways can leaders facilitate cognitive reframing and emotional regulation techniques to promote constructive conflict resolution ?

-

What is the level of sales needed to achieve a 10% return on an investment of $10,000,000 for a restaurant (the restaurant has main products it sells: food, beverage and gift shop items) and cover...

-

1. An online computer assembling mobile phone Application provides interfaces for end users to assemble computers by selecting computer accessories with different configurations from different...

-

1. (# 3.21, Text) Plot the longitudinal and transverse coefficients of thermal expansion for a unidirectional glass-polyester composite as functions of fiber volume fraction. Assume the following...

-

The maximum strain of a steel wire with Youngs modulus 200 GPa, just before breaking, is 0.20%. What is the stress at its breaking point, assuming that strain is proportional to stress up to the...

-

Which property determines whether a control is available to the user during run time? a. Available b. Enabled c. Unavailable d. Disabled

-

Describe how the following business transactions affect the three elements of the accounting equation. a. Received cash for services performed. b. Paid for utilities used in the business. c. Borrowed...

-

How are revenues and expenses reported on the income statement under? (a) The cash basis of accounting and (b) The accrual basis of accounting?

-

How are revenues and expenses reported on the income statement under? (a) The cash basis of accounting and (b) The accrual basis of accounting?

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

Study smarter with the SolutionInn App