Question: Prepare fund flow statement and carry out inferences. Additional information: (i) Investments costing 8,000 were sold during the year 200910 for 8,500. (ii) Provision for

Prepare fund flow statement and carry out inferences.

Additional information:

(i) Investments costing ₹8,000 were sold during the year 2009–10 for ₹8,500.

(ii) Provision for tax made during the year 2009–10 was ₹9,000.

(iii) During the year part of the fixed asset costing (book value) 10,000 was sold for ₹12,000 and profit included in the profit and loss account.

(iv) Dividend paid during the year 2009–10 was ₹40,000.

(v) During the year company issued bonus shares of ₹40,000 by capitalizing reserves.

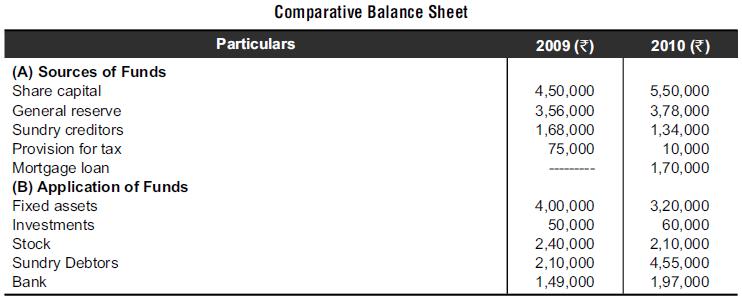

(A) Sources of Funds Share capital General reserve Sundry creditors Provision for tax Mortgage loan (B) Application of Funds Fixed assets Investments Stock Sundry Debtors Bank Comparative Balance Sheet Particulars 2009 () 4,50,000 3,56,000 1,68,000 75,000 4,00,000 50,000 2,40,000 2,10,000 1,49,000 2010 () 5,50,000 3,78,000 1,34,000 10,000 1,70,000 3,20,000 60,000 2,10,000 4,55,000 1,97,000

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Working Notes i To calculate depreciation for the year we need to make fixed asset account ii Tax pa... View full answer

Get step-by-step solutions from verified subject matter experts