Answered step by step

Verified Expert Solution

Question

1 Approved Answer

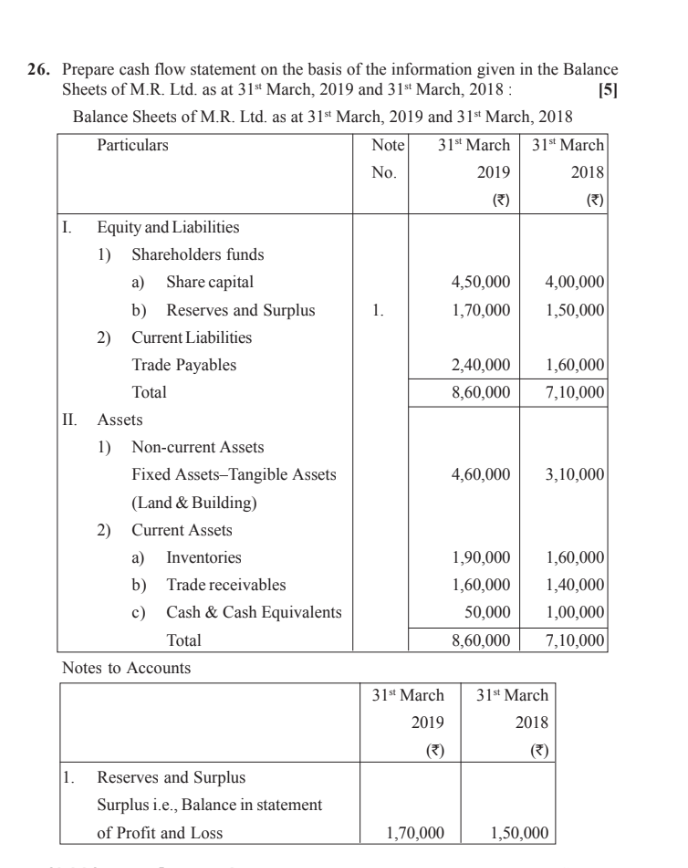

26. Prepare cash flow statement on the basis of the information given in the Balance Sheets of M.R. Ltd. as at 31 1st March, 2019

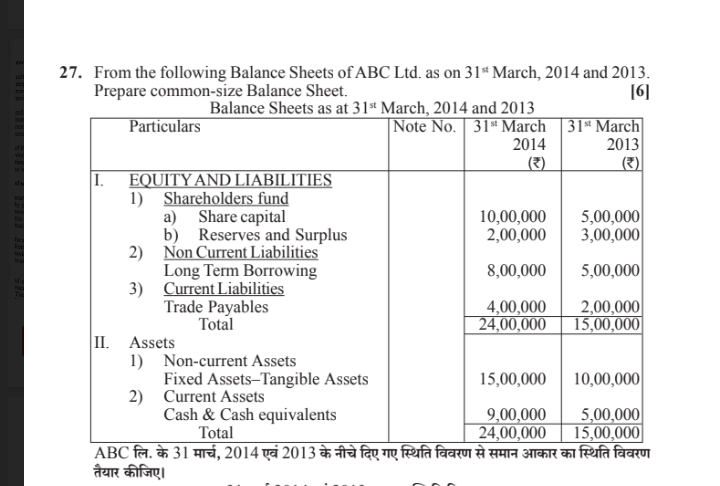

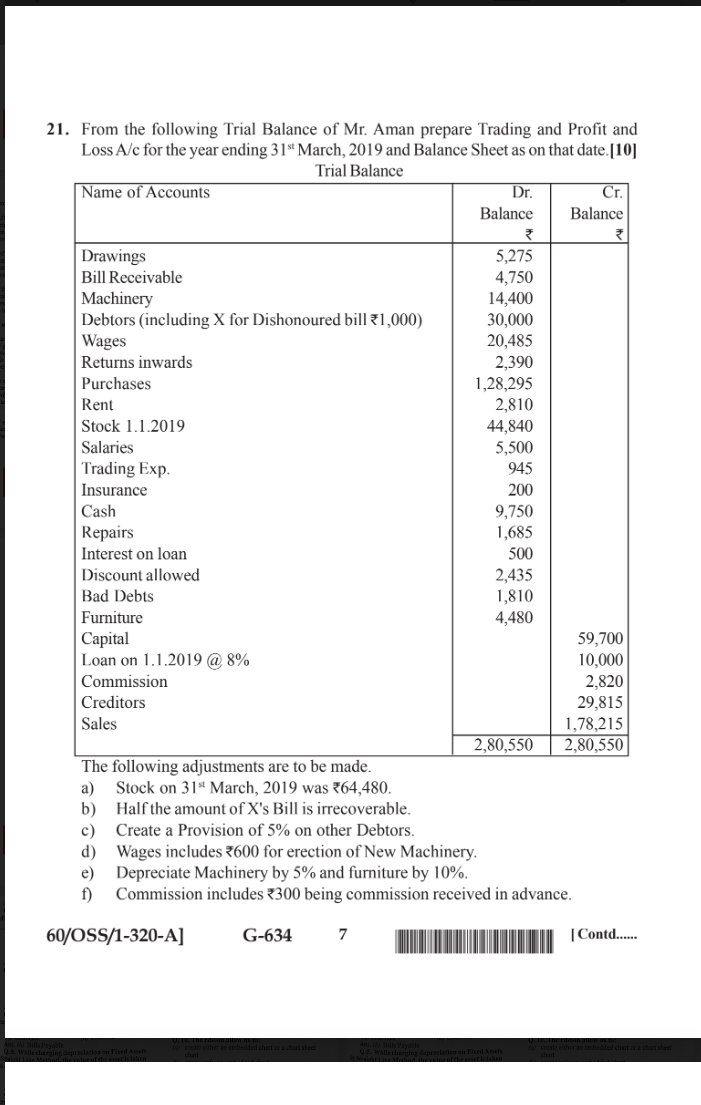

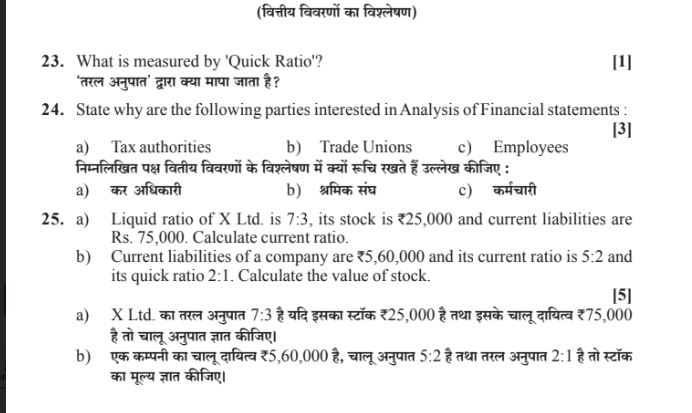

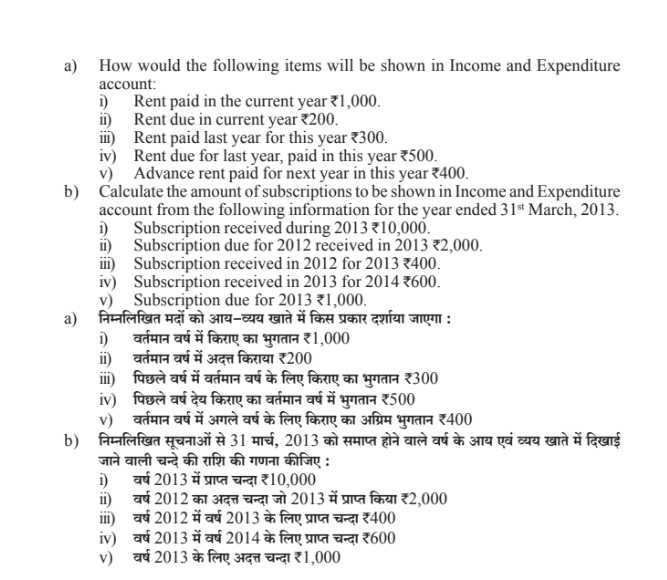

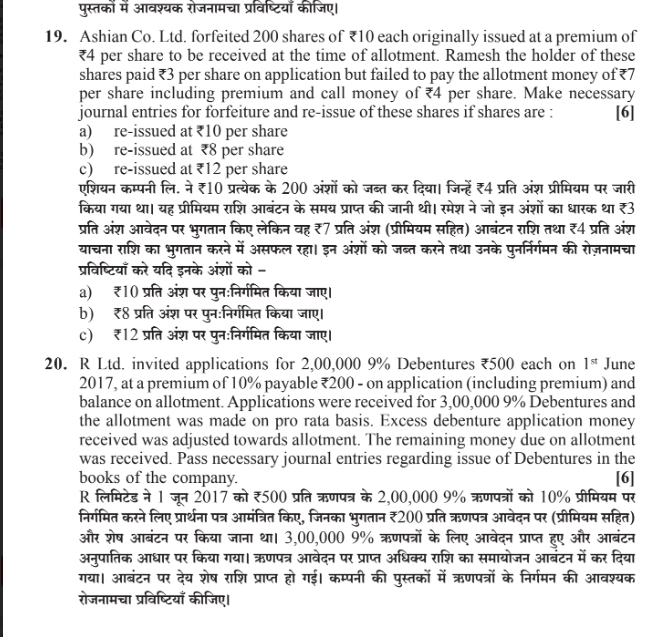

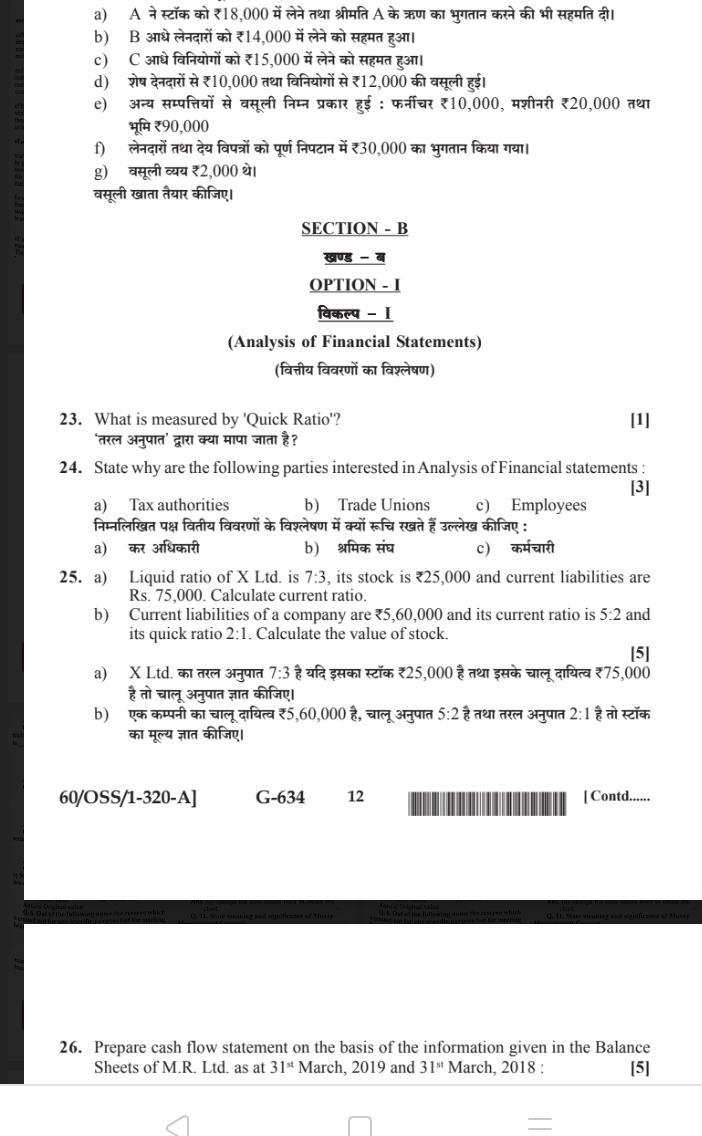

26. Prepare cash flow statement on the basis of the information given in the Balance Sheets of M.R. Ltd. as at 31 1st March, 2019 and 31st March, 2018 : [5] 7. From the following Balance Sheets of ABC Ltd. as on 31 31st March, 2014 and 2013. Prepare common-size Balance Sheet. [6] Ralance Sheets as at 31st March 2014 and 2013 ABC . 31 , 2014 2013 21. From the following Trial Balance of Mr. Aman prepare Trading and Profit and Loss A/c for the year ending 31st March, 2019 and Balance Sheet as on that date.[10] a) Stock on 31st March, 2019 was 64,480. b) Half the amount of X's Bill is irrecoverable. c) Create a Provision of 5% on other Debtors. d) Wages includes 600 for erection of New Machinery. e) Depreciate Machinery by 5% and furniture by 10%. f) Commission includes 300 being commission received in advance. 19. Ashian Co. Ltd. forfeited 200 shares of 10 each originally issued at a premium of 4 per share to be received at the time of allotment. Ramesh the holder of these shares paid 3 per share on application but failed to pay the allotment money of 7 per share including premium and call money of 4 per share. Make necessary journal entries for forfeiture and re-issue of these shares if shares are : [6] a) re-issued at 10 per share b) re-issued at 8 per share c) re-issued at 12 per share . 10 200 4 3 7 ( ) 4 - a) 10 b) 8 : c) 12 20. R Ltd. invited applications for 2,00,0009% Debentures 500 each on 1st June 2017 , at a premium of 10% payable 200 - on application (including premium) and balance on allotment. Applications were received for 3,00,000 9\% Debentures and the allotment was made on pro rata basis. Excess debenture application money received was adjusted towards allotment. The remaining money due on allotment was received. Pass necessary journal entries regarding issue of Debentures in the books of the company. [6] R 1 2017 500 2,00,0009% 10% , 200 ( ) 3,00,0009% a) How would the following items will be shown in Income and Expenditure account: i) Rent paid in the current year 1,000 . ii) Rent due in current year 200. iii) Rent paid last year for this year 300. iv) Rent due for last year, paid in this year 500. v) Advance rent paid for next year in this year 400. b) Calculate the amount of subscriptions to be shown in Income and Expenditure account from the following information for the year ended 31st March, 2013. i) Subscription received during 2013 10,000 . ii) Subscription due for 2012 received in 2013 2,000. iii) Subscription received in 2012 for 2013400. iv) Subscription received in 2013 for 2014 600. v) Subscription due for 20131,000. a) - : i) 1,000 ii) 200 iii) 300 iv) 500 v) 400 b) 31 , 2013 : i) 2013 10,000 ii) 2012 2013 2,000 iii) 2012 2013 400 iv) 2013 2014 600 v) 2013 1,000 23. What is measured by 'Quick Ratio'? [1] ' ' ? 24. State why are the following parties interested in Analysis of Financial statements : a) Tax authorities b) Trade Unions c) Employees [3] : a) b) c) 25. a) Liquid ratio of X Ltd. is 7:3, its stock is 25,000 and current liabilities are Rs. 75,000. Calculate current ratio. b) Current liabilities of a company are 5,60,000 and its current ratio is 5:2 and its quick ratio 2:1. Calculate the value of stock. [5] a) X Ltd. 7:3 25,000 75,000 b) 5,60,000 , 5:2 2:1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started