Question:

Refer to Apple Inc.’s consolidated financial statements in Appendix A and online in the filings section of www.sec.gov.

Requirements

1. Using the Revenue Recognition section of Note 1 as a reference, describe how Apple Inc., recognizes revenue. From what types of activities does Apple earn its revenue?

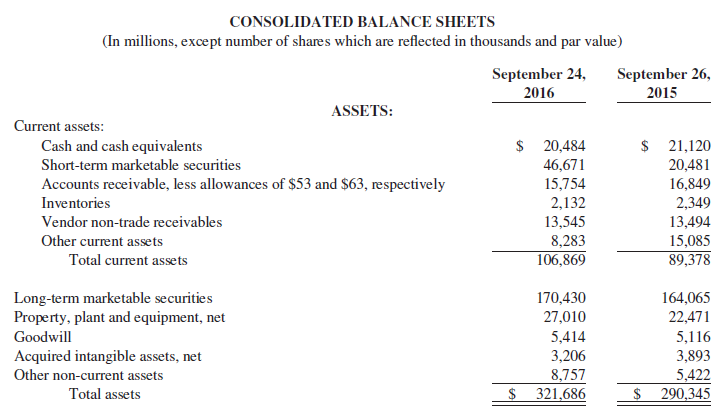

2. The third account listed on Apple’s Consolidated Balance Sheet is called “Accounts receivable, less allowances.” To what does the “allowances” refer?

3. Refer to the Accounts Receivable section of Note 2. What kinds of accounts receivable are included in Apple Inc.’s receivables?

4. How much is the allowance for uncollectible accounts in 2016 and 2015?

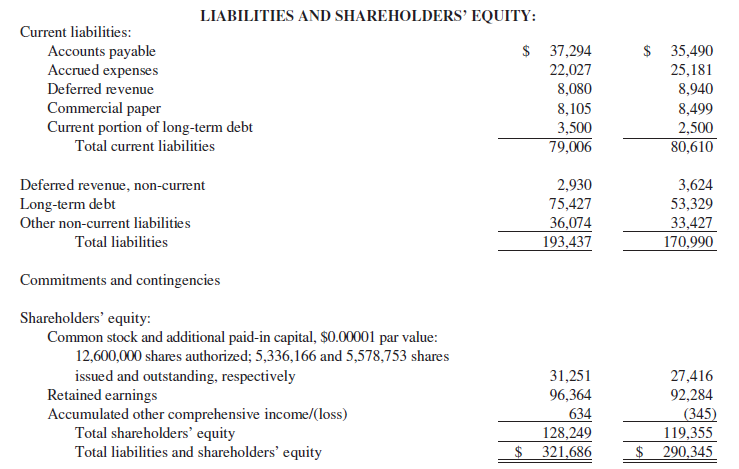

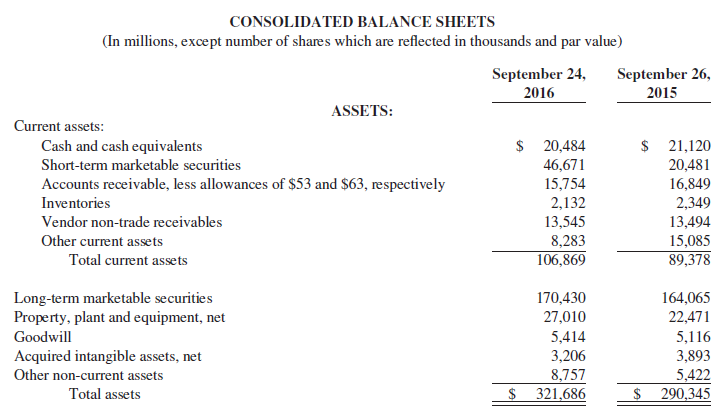

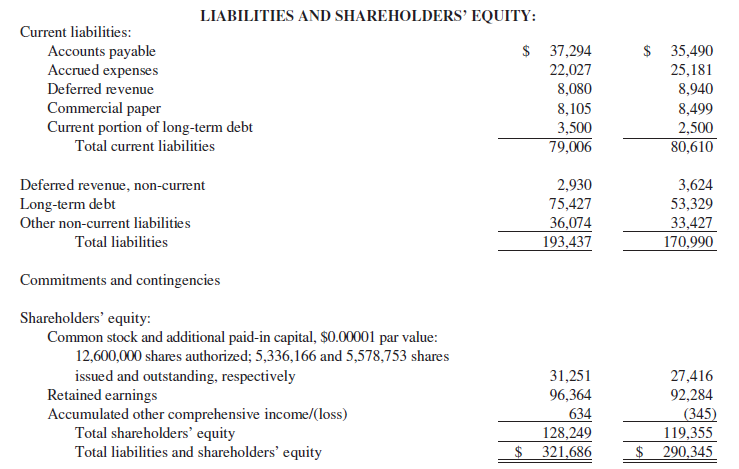

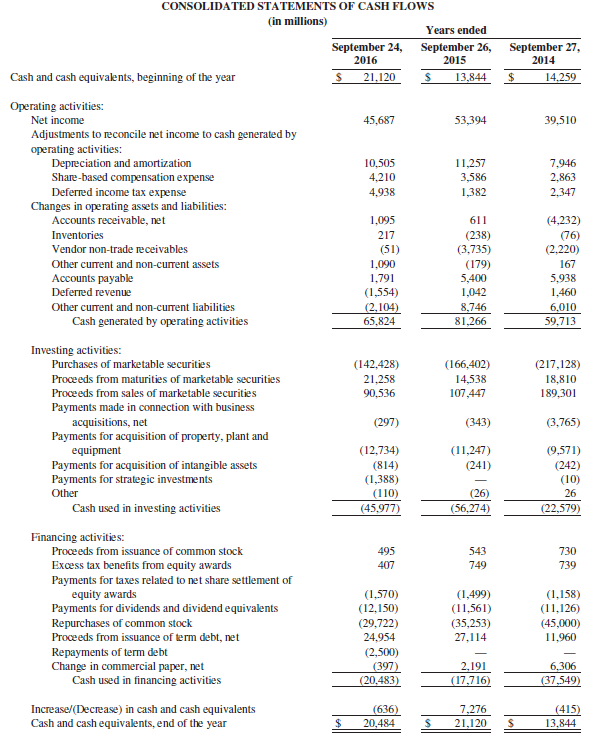

5. Calculate the current ratio, quick (acid-test) ratio, and net working capital for Apple Inc., for 2016 and 2015. Evaluate Apple Inc.’s liquidity trend over the two years. What other information might be helpful in evaluating these statistics?

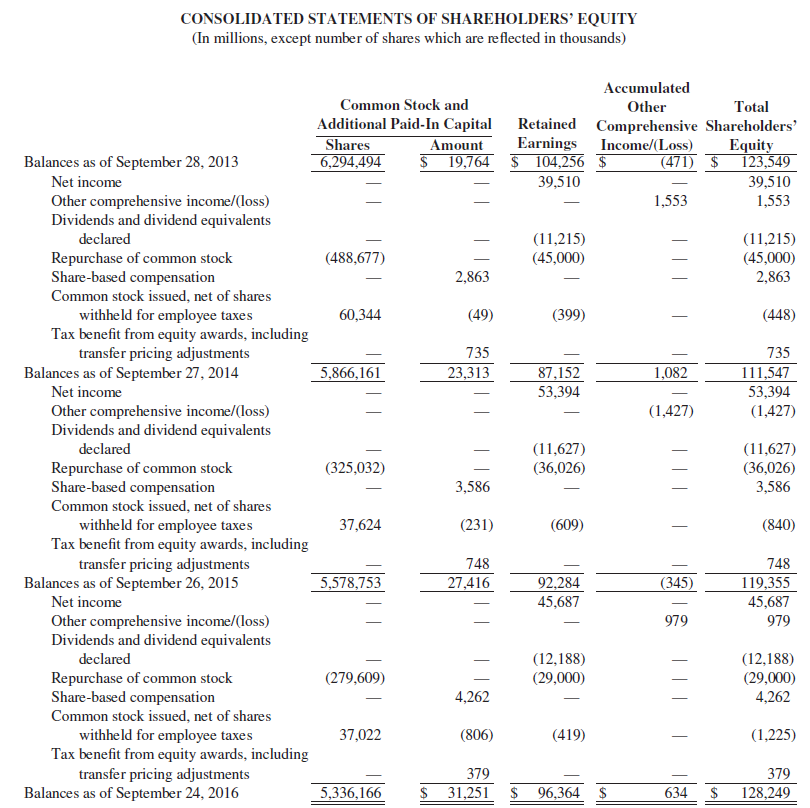

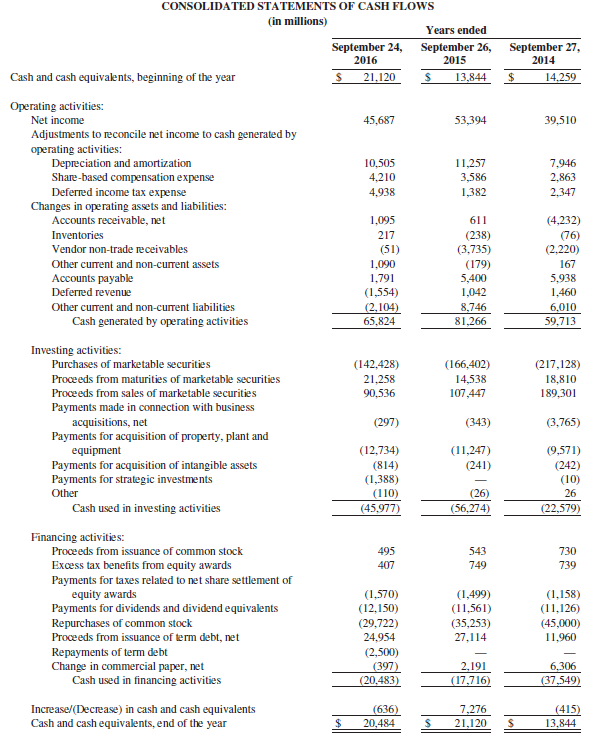

Data from Apple Inc.'s

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

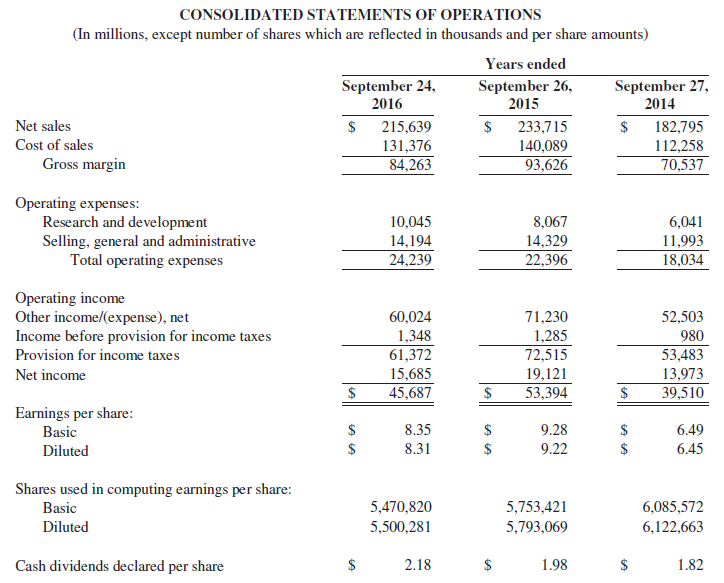

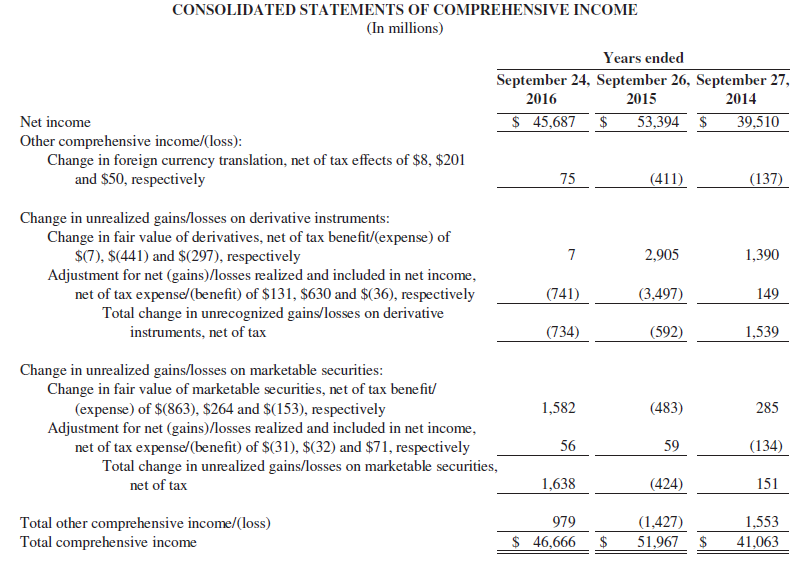

Transcribed Image Text:

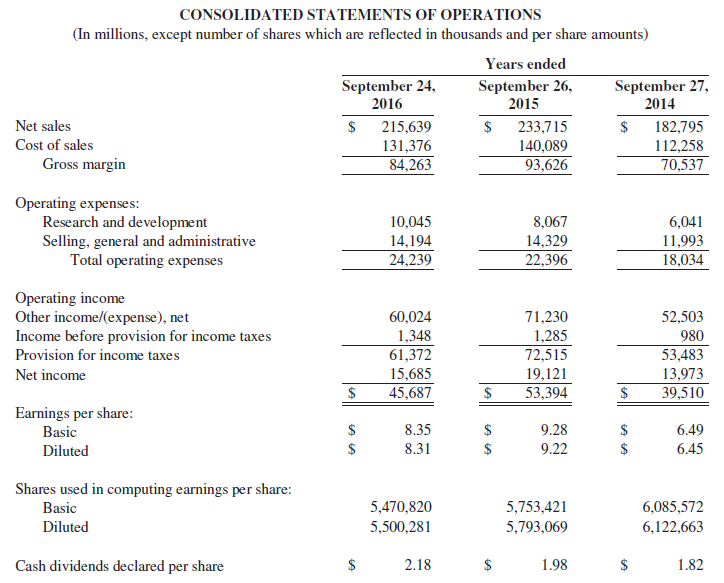

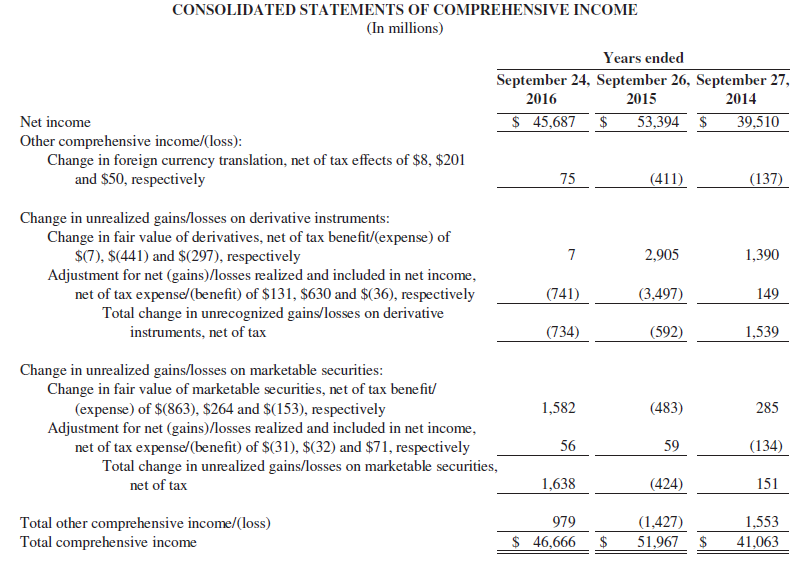

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 26, 2015 September 24, 2016 September 27, 2014 Net sales 215,639 131,376 84,263 233,715 140,089 93,626 182,795 Cost of sales 112,258 70,537 Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses 6,041 10,045 14,194 24,239 8,067 14,329 22,396 11,993 18,034 Operating income Other income/(expense), net Income before provision for income taxes 60,024 1,348 61,372 71,230 1,285 72,515 52,503 980 53,483 Provision for income taxes 19,121 15,685 45,687 13,973 Net income 53,394 39,510 Earnings per share: Basic 2$ 8.35 9.28 6.49 8.31 9.22 6.45 Diluted Shares used in computing earnings per share: Basic 5,470,820 5,753,421 6,085,572 5,500,281 Diluted 5,793,069 6,122,663 Cash dividends declared per share 2.18 1.98 1.82 %24 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 24, September 26, September 27, 2016 2015 2014 Net income $ 45,687 53,394 $ 39,510 Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $8, $201 and $50, respectively 75 (411) (137) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $7), $(441) and $(297), respectively Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $131, $630 and $(36), respectively Total change in unrecognized gains/losses on derivative 2,905 1,390 (741) (3,497) 149 instruments, net of tax (734) (592) 1,539 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/ (expense) of $(863), $264 and $(153), respectively Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $(31), $(32) and $71, respectively Total change in unrealized gains/losses on marketable securities, 1,582 (483) 285 56 59 (134) net of tax 1,638 (424) 151 979 (1,427) 1,553 Total other comprehensive income/(loss) Total comprehensive income $ 46,666 51,967 $ 41,063