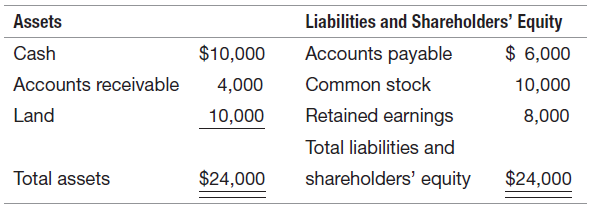

The December 31, 2017 balance sheet for Morrison Home Services is summarized below. During January 2018, the

Question:

During January 2018, the following transactions were entered into:

1. Services were performed for $7,000 cash.

2. $3,000 cash was received from customers on outstanding accounts receivable.

3. $3,000 cash was paid for outstanding liabilities.

4. Land was purchased in exchange for a $6,000 note payable.

5. Expenses of $4,000 were paid in cash.

6. A dividend of $800 was issued to the owners.

REQUIRED:

a. Provide a journal entry for each transaction.

b. Treat each transaction independently and describe how each would affect Morrison€™s current ratio, return on equity, and debt/equity ratio, respectively.

c. Prepare the income statement, statement of shareholders€™ equity, the January 31 balance sheet, and the statement of cash flows (direct method) for January.

d. Prepare the operating section of the statement of cash flows under the indirect method.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: