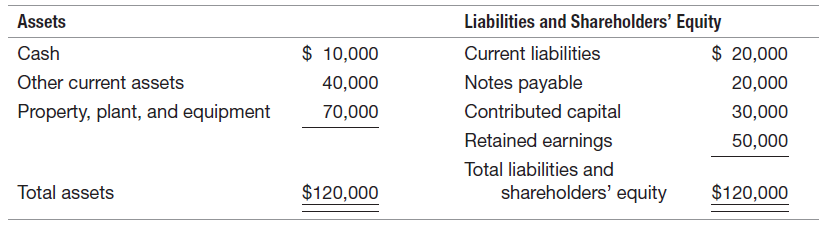

The following condensed balance sheet for December 31, 2017, comes from the records of Buzz and Associates:

Question:

Buzz and Associates is considering the purchase of a new piece of equipment for $30,000. The company does not have enough cash to purchase it outright, so it is considering alternative ways of financing. As management sees it, there are three basic options: (1) issue 3,000 ownership shares for $10 per share, (2) take out a long-term loan (12 percent annual interest) for $30,000 from the bank, or (3) purchase the equipment on open account (must be paid in full in 30 days). Presently Buzz has 12,000 ownership shares outstanding.

REQUIRED:

a. Compute the present current ratio (current assets/current liabilities), the debt/equity ratio (total liabilities/ shareholders€™ equity), and the book value of Buzz€™s outstanding ownership shares: (total assets minus total liabilities divided by number of shares outstanding).

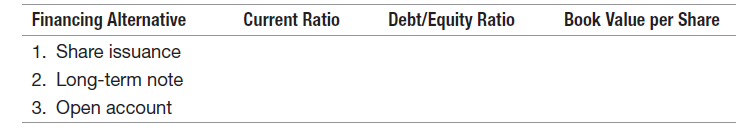

b. Compute the current ratio, debt/equity ratio, and book value per share under each of the three financing alternatives, and express your answers in the following format:

c. Discuss some of the pros and cons associated with each of the three financing options.

d. The chairman of the board of directors stated at a recent board meeting that with $50,000 in Retained Earnings, the company should be able to purchase the $30,000 piece of equipment. Comment on the chairman€™s statement.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: