The president of The Peterson Company suspects the bookkeeper is embezzling cash from the company. She asks

Question:

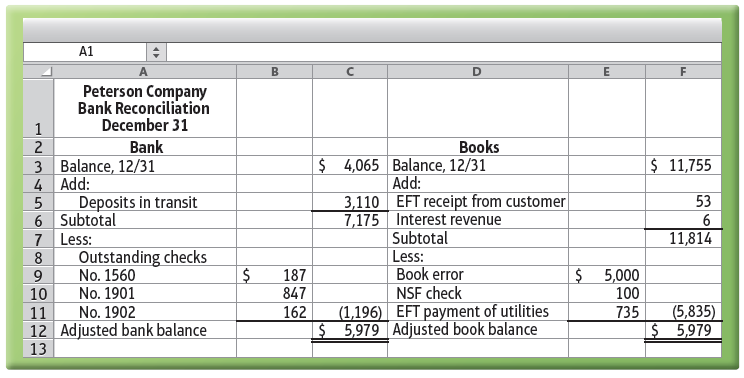

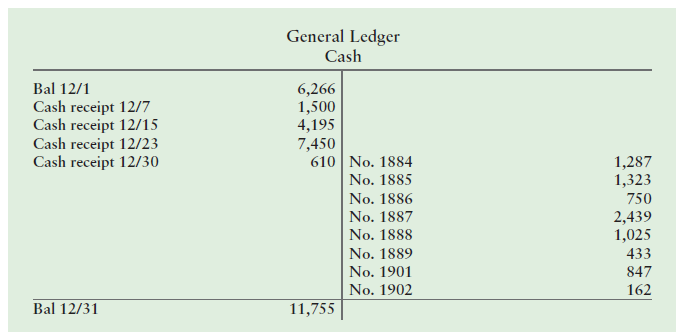

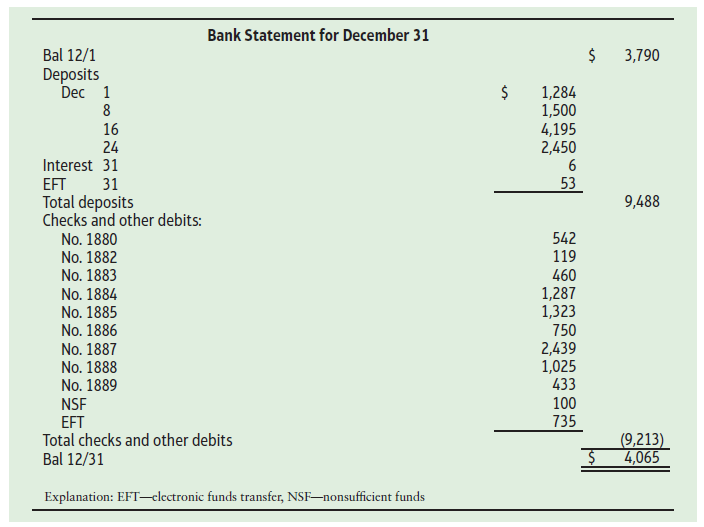

The president of The Peterson Company suspects the bookkeeper is embezzling cash from the company. She asks you, confidentially, to look over the bank reconciliation that the bookkeeper has prepared to see if you discover any discrepancies between the books and the bank statement. She provides you with the Cash account from the general ledger, the bank statement, and the bank reconciliation as of December 31. You learn from the November bank reconciliation that the following checks were outstanding on November 30: No. 1560 for $187, No. 1880 for $542, No. 1882 for $119, and No. 1883 for $460. There was one deposit in transit on November 30 for $1,284. An examination of the actual deposit slips revealed no bank errors. Assume the cash deposit of $2,450 on December 24 is the correct amount. The January bank statement showed that a $610 deposit cleared the bank on January 2.

Requirement

1. Prepare a corrected bank reconciliation. Show the unexplained difference as an adjustment to the book balance. Include in your analysis the amount of the theft and how the bookkeeper attempted to conceal the theft.

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.