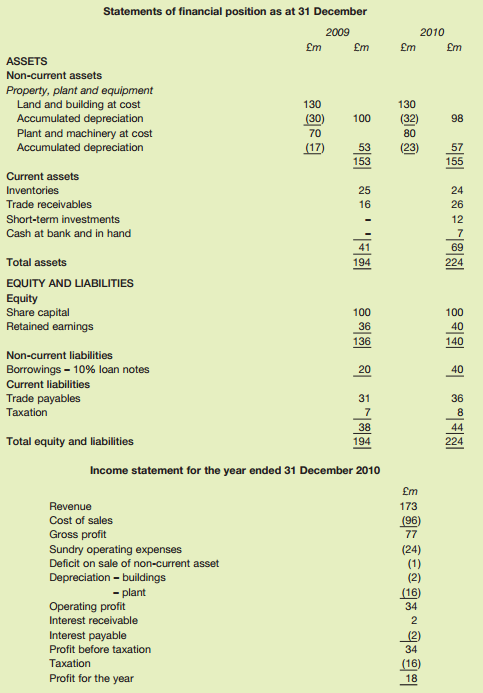

The statements of financial position of Axis plc as at 31 December 2009 and 2010 and the

Question:

During the year, plant (a non-current asset) costing £15 million and with accumulated depreciation of £10 million was sold. The short-term investments were government securities, where there was little or no risk of loss of value. The expense and the cash outflow for interest payable were equal. During 2010 a dividend of £14 million was paid.

Required:

Prepare a statement of cash flows for Axis plc for the year ended 31 December 2010.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Statements of financial position as at 31 December 2009 2010 £m £m £m £m ASSETS Non-current assets Property, plant and equipment Land and building at cost Accumulated depreciation 130 130 (30) 100 (32) 98 Plant and machinery at cost Accumulated depreciation 70 80 (17) 53 (23) 57 153 155 Current assets Inventories 25 24 Trade receivables 16 26 Short-term investments 12 Cash at bank and in hand 41 69 224 Total assets 194 EQUITY AND LIABILITIES Equity Share capital Retained eamings 100 100 36 40 136 140 Non-current liabilities Borrowings - 10% loan notes 20 40 Current liabilities Trade payables 31 36 Тахation 38 44 Total equity and liabilities 194 224 Income statement for the year ended 31 December 2010 £m Revenue 173 Cost of sales (96) Gross profit Sundry operating expenses Deficit on sale of non-current asset 77 (24) Depreciation - buildings - plant Operating profit (2) (16) 34 Interest receivable Interest payable (2) Profit before taxation 34 Тахation (16) Profit for the year 18

Step by Step Answer:

Axis plc Statement of cash flows for the year ended 31 December 2010 m Cash flows from operating activities Profit before taxation after interest see ...View the full answer

Financial Accounting for Decision Makers

ISBN: 978-0273763451

6th Edition

Authors: Peter Atrill, Eddie McLaney

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The statements of financial position of Parkway plc for 20X7 and 20X8 are given below, together with the income statement for the year ended 30 June 20X8. Statement of comprehensive income of Parkway...

-

Rouge plc acquired 100% of the common shares of Noir plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Required:...

-

The statements of financial position of Mars plc and Jupiter plc at 31 December 20X2 are as follows: Statements of comprehensive income for the year ended 31 December 20X2 Mars acquired 80% of the...

-

Is Madisons response regarding the factors that affect short-term and long-term rate volatility correct? A. Yes B. No, she is incorrect regarding factors linked to long-term rate volatility C. No,...

-

In a public corporation, the principal-agent problem between ownership and top management results from asymmetric information. What information, if known, would prevent this principal-agent problem?

-

How could managers use the job characteristics model to encourage and support workforce diversity efforts? Explain. LO3

-

Which of the following is a characteristic of a highly involved consumer? a. Greater interest in the product b. Spending more time researching the product c. Engaging in extensive problem solving d....

-

Is there a relationship between the race of violent offenders and their victims? Data from the U.S. Department of Justice (Expanded Homicide Data Table 6, 2011) are presented below. a. Let's treat...

-

What is the difference between a primary and secondary stock market? List five major stock market indexes. Is the stock market a good intensification of economic activity?

-

Allante Pizza delivers pizzas throughout its local market area at no charge to the customer. However, customers often tip the driver. The owner is interested in estimating the mean tip income per...

-

What causes the profit for the year not to equal the net cash inflow?

-

What potential problems arise for the external analyst from the use of statement of financial position figures in the calculation of financial ratios?

-

Guarino and two others (plaintiffs) died of gas asphyxiation and five others were injured when they entered a sewer tunnel without masks to answer the cries for help of their crew leader, Rooney....

-

Waverly Company Ltd. currently produces 8,000 units per year of SB 200 (snowboard), which is a component of the company's major products. SB 200 has the following unit cots Direct materials - $35.50...

-

Norton Ltd manufactures a single product, which is sold for $150 per unit. The standard variable costs per unit of the product are: Direct material 4 kilos at $8 per kilo Direct labour 5 hours at $10...

-

QUESTION 4 Murni Selasih Bhd is considering investing in a project that will generate higher returns Currently, the company has two projects with forecasted outcomes under consideration. The possible...

-

ABC plans to sell 60,000 units of product 751 in June, and each of these units requires five sq. ft. of raw material. Additional data is as follows: Product Raw No. 751 Material Actual June 1 11,200...

-

Case: Tom has felt anxious and constantly on edge over the past 3 years. He has few social contacts because of his nervous symptoms. He is married with 3 children and worries about if he is a good...

-

Journalize the following transactions. Assume the perpetual inventory system. 202X Apr. 16 5 Sold merchandise for $1,250 cash. The cost of the merchandise was $850. Made refunds to cash customers for...

-

Tell whether the angles or sides are corresponding angles, corresponding sides, or neither. AC and JK

-

A local education authority is faced with a predicted decline in the demand for school places in its area. It is believed that some schools will have to close in order to remove up to 800 places from...

-

Rob Otics Ltd, a small business that specialises in manufacturing electronic-control equipment, has just received an inquiry from a potential customer for eight identical robotic units. These would...

-

Define the terms fixed cost and variable cost. Explain how an understanding of the distinction between fixed cost and variable cost can be useful to managers.

-

This short exercise demonstrates the similarity and the difference between two ways to acquire plant assets. (Click the icon to view the cases.) Compare the balances in all the accounts after making...

-

Balance sheet and income statement data for two affiliated companies for the current year appear below: BALANCE SHEET As at December 31, Year 6 Albeniz Bach Cash $ 40,000 $ 21,000 Receivables 92,000...

-

please reference excel cells Caroll Manufacturing company manufactures a single product. During the past three weeks, Caroll's cost accountant observed that output costs varied considerably. The...

Study smarter with the SolutionInn App