The statements of financial position of Mars plc and Jupiter plc at 31 December 20X2 are as follows: Statements of comprehensive income for the year

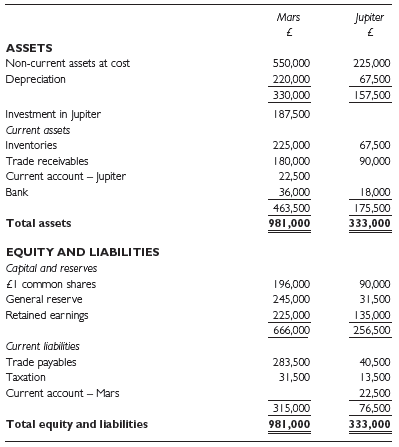

The statements of financial position of Mars plc and Jupiter plc at 31 December 20X2 are as follows:

Statements of comprehensive income for the year ended 31 December 20X2

Mars acquired 80% of the shares in Jupiter on 1 January 20X0 when Jupiter’s retained earnings were £80,000 and the balance on Jupiter’s general reserve was £18,000. Non-controlling interests are measured using method 1. During the year Mars sold Jupiter goods for £18,000 which represented cost plus 50%. Half of these goods were still in stock at the end of the year.

During the year Mars and Jupiter paid dividends of £180,000 and £11,250 respectively. The opening balances of retained earnings for the two companies were £156,000 and £114,750 respectively.

Required:

Prepare a consolidated statement of comprehensive income for the year ended 31/12/20X2, a statement of financial position as at that date, and a consolidated statement of changes in equity. Also prepare the retained earnings columns of the consolidated statement of changes in equity for theyear.

Jupiter Mars ASSETS Non-current assets at cost 550,000 225,000 Depreciation 220,000 67,500 330,000 157,500 Investment in Jupiter 187,500 Current assets Inventories 225,000 67,500 Trade receivables 180,000 90,000 Current account Jupiter 22,500 Bank 36,000 18,000 463,500 175,500 333,000 Total assets 981,000 EQUITY AND LIABILITIES Capital and reserves l common shares 196,000 90,000 General reserve 245,000 31,500 Retained earnings 225,000 135,000 666,000 256,500 Current liabiities Trade payables 283,500 40,500 Taxation 31,500 13,500 Current account Mars 22,500 315,000 76,500 Total equity and liabilities 981,000 333,000

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Statement of financial position as at 31 December 20X2 Assets Noncurrent assets 330000 157500 487500 Goodwill 37100 Current assets Inventories 225000 ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

168-B-A-G-F-A (1137).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards