Question: Your client has two children. The younger one just turned 2, and the older one just turned 4. They are expected to go to college

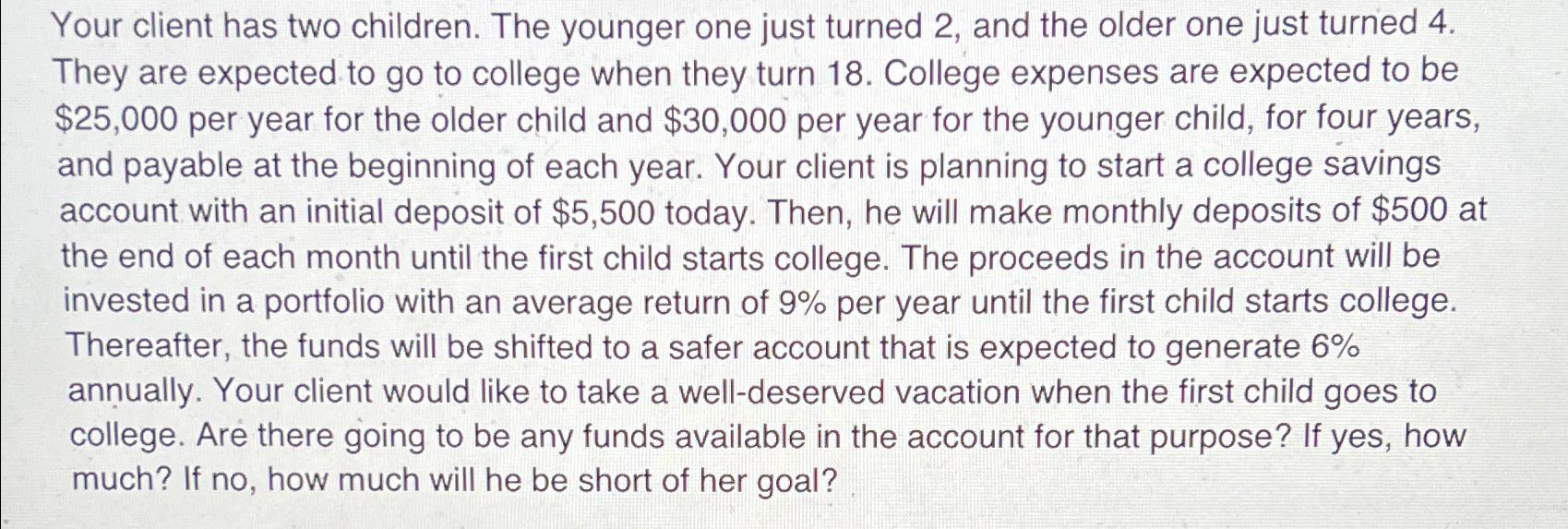

Your client has two children. The younger one just turned 2, and the older one just turned 4. They are expected to go to college when they turn 18. College expenses are expected to be

$25,000per year for the older child and

$30,000per year for the younger child, for four years, and payable at the beginning of each year. Your client is planning to start a college savings account with an initial deposit of

$5,500today. Then, he will make monthly deposits of

$500at the end of each month until the first child starts college. The proceeds in the account will be invested in a portfolio with an average return of

9%per year until the first child starts college. Thereafter, the funds will be shifted to a safer account that is expected to generate

6%annually. Your client would like to take a well-deserved vacation when the first child goes to college. Are there going to be any funds available in the account for that purpose? If yes, how much? If no, how much will he be short of her goal?

Your client has two children. The younger one just turned 2 , and the older one just turned 4. They are expected to go to college when they turn 18. College expenses are expected to be $25,000 per year for the older child and $30,000 per year for the younger child, for four years, and payable at the beginning of each year. Your client is planning to start a college savings account with an initial deposit of $5,500 today. Then, he will make monthly deposits of $500 at the end of each month until the first child starts college. The proceeds in the account will be invested in a portfolio with an average return of 9% per year until the first child starts college. Thereafter, the funds will be shifted to a safer account that is expected to generate 6% annually. Your client would like to take a well-deserved vacation when the first child goes to college. Are there going to be any funds available in the account for that purpose? If yes, how much? If no, how much will he be short of her goal? Your client has two children. The younger one just turned 2 , and the older one just turned 4. They are expected to go to college when they turn 18. College expenses are expected to be $25,000 per year for the older child and $30,000 per year for the younger child, for four years, and payable at the beginning of each year. Your client is planning to start a college savings account with an initial deposit of $5,500 today. Then, he will make monthly deposits of $500 at the end of each month until the first child starts college. The proceeds in the account will be invested in a portfolio with an average return of 9% per year until the first child starts college. Thereafter, the funds will be shifted to a safer account that is expected to generate 6% annually. Your client would like to take a well-deserved vacation when the first child goes to college. Are there going to be any funds available in the account for that purpose? If yes, how much? If no, how much will he be short of her goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts