Question:

This exercise should be used in conjunction with Exercises 1-39B through 1-41B.

The owner of Island Coffee Roasters Corporation now seeks your advice as to whether she should cease operations or continue the business. Complete the report giving her your opinion of net income, dividends, financial position, and cash flows during her first month of operations. Cite specifics from the financial statements to support your opinion. Conclude your memo with advice on whether to stay in business or cease operations.

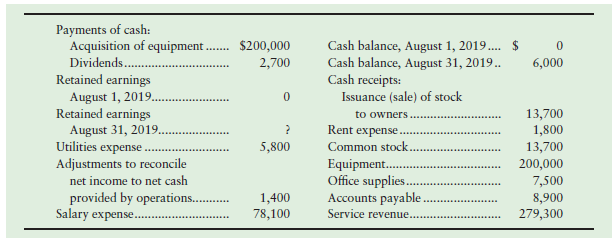

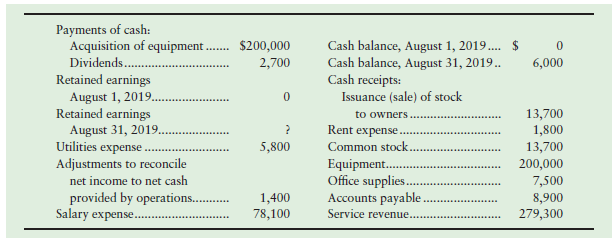

Data from Exercise 1-39B to 1-40

Assume Island Coffee Roasters Corporation ended the month of August 2019 with these data:

Exhibit 1-11

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Transcribed Image Text:

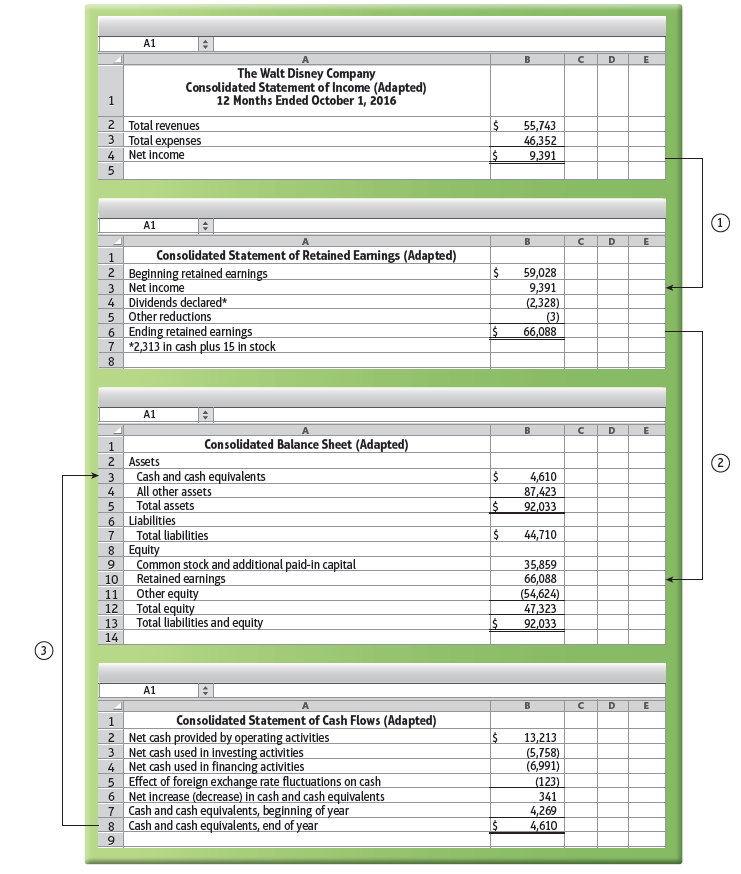

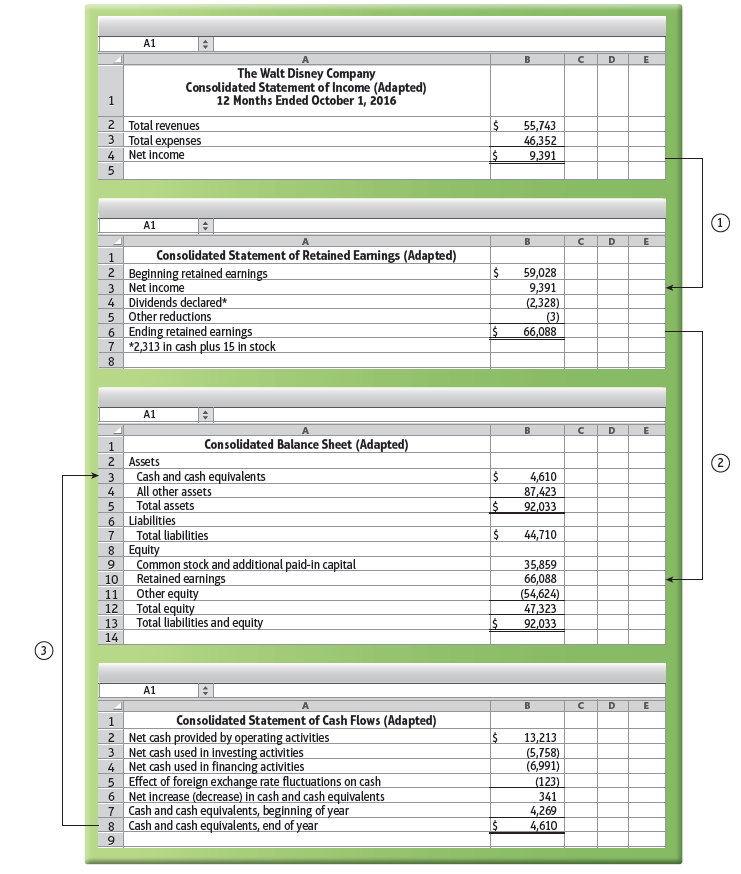

Payments of cash: Acquisition of equipment .. Cash balance, August 1, 2019.. Cash balance, August 31, 2019.. Cash receipts: Issuance (sale) of stock to owners Rent expense. Common stock. Equipment.. Office supplies.. Accounts payable . Service revenue... .... $200,000 2,700 $ 6,000 .... Dividends. Retained earnings August 1, 2019. Retained earnings August 31, 2019.. Utilities expense. Adjustments to reconcile net income to net cash provided by operations.. Salary expense. 13,700 1,800 13,700 200,000 7,500 8,900 279,300 5,800 1,400 78,100 A1 The Walt Disney Company Consolidated Statement of Income (Adapted) 12 Months Ended October 1, 2016 2 Total revenues 3 Total expenses 55,743 46,352 Net income 9.391 A1 1 Consolidated Statement of Retained Eamings (Adapted) 2 Beginning retained earnings 3 Net income 4 Dividends declared* 5 Other reductions 6 Ending retained earnings 7 *2,313 in cash plus 15 in stock 59,028 9,391 (2,328) (3) 66,088 A1 Consolidated Balance Sheet (Adapted) 2 Assets Cash and cash equivalents 4,610 87,423 92,033 3 All other assets Total assets 6 Liabilities Total liabilities 8 Equity Common stock and additlonal paid-in capital Retained earnings 44,710 35,859 66,088 (54,624) 47,323 92,033 10 11 Other equity Total equity Total liabilities and equity 12 13 14 A1 Consolidated Statement of Cash Flows (Adapted) 2 Net cash provided by operating activities 3 Net cash used in Investing activities 4 Net cash used in financing activities 5 Effect of foreign exchange rate fluctuations on cash 6 Net increase (decrease) in cash and cash equivalents 7 Cash and cash equlvalents, beginning of year 8 Cash and cash equivalents, end of year 13,213 (5,758) (6,991) (123) 341 4,269 4,610 lu