Question: Under U.S. GAAP, LIFO is an acceptable inventory method. Listed below is financial statement information for three companies that use LIFO. All table numbers are

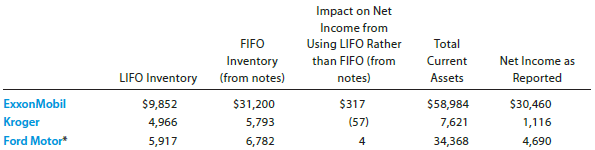

Under U.S. GAAP, LIFO is an acceptable inventory method. Listed below is financial statement information for three companies that use LIFO. All table numbers are in millions of dollars.

*Autos and trucks only

Assume these companies adopted IFRS, and thus were required to use FIFO, rather than LIFO.

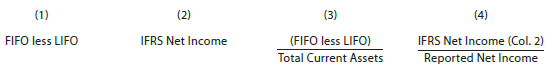

a. Prepare a table with the following columns:

(1) Difference between FIFO and LIFO inventory valuation.

(2) Revised IFRS net income using FIFO.

(3) Difference between FIFO and LIFO inventory valuation as a percent of total current assets.

(4) Revised IFRS net income as a percent of the reported net income.

b. Complete the table for the three companies.

c. For which company would a change to IFRS for inventory valuation have the largest percentage impact on total current assets (Col. 3)?

d. For which company would a change to IFRS for inventory valuation have the largest percentage impact on net income (Col. 4)?

e. Why might Kroger have a negative impact on net income from using LIFO, while the other two companies have a positive impact on net income from using LIFO?

Impact on Net Income from Using LIFO Rather than FIFO (from FIFO Inventory (from notes) Total Current Assets Net Income as Reported $30,460 1,116 LIFO Inventory $9,852 4,966 5,917 notes) $58,984 7,621 34,368 ExxonMobil Kroger $317 (57) $31,200 5,793 Ford Motor* 6,782 4,690 (1) (2) (3) (4) (FIFO less LIFO) Total Current Assets IFRS Net Income (Col. 2) Reported Net Income FIFO less LIFO IFRS Net Income

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

a and b 1 FIFO less LIFO 2 IFRS Net Income 3 FIFO less LIFO Total Current Assets 4 IFRS Net Income Col 2 Reported Net Income Exxon Mobil 21348 30143 3... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1504_60b7418be413e_665511.pdf

180 KBs PDF File

1504_60b7418be413e_665511.docx

120 KBs Word File