Use the financial statements of Metro Corporation in S12-6 and S12-7 to calculate these profitability measures for

Question:

Use the financial statements of Metro Corporation in S12-6 and S12-7 to calculate these profitability measures for 2018. Show each calculation.

a. Rate of return on sales

b. Asset turnover ratio

c. Rate of return on total assets

d. Leverage (equity multiplier) ratio

e. Rate of return on common stockholders’ equity

f. Is Metro’s profitability strong, medium, or weak?

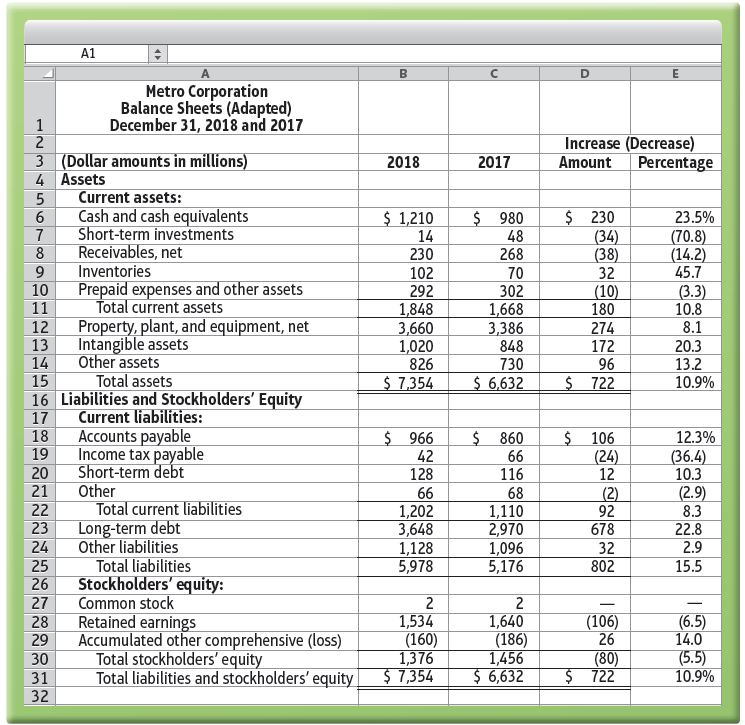

Data from S12-6

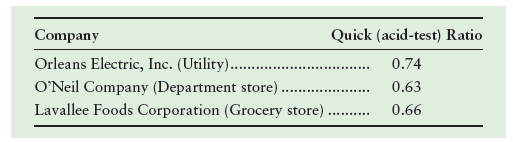

To follow are the balance sheets for Metro Corporation and selected comparative competitor data.

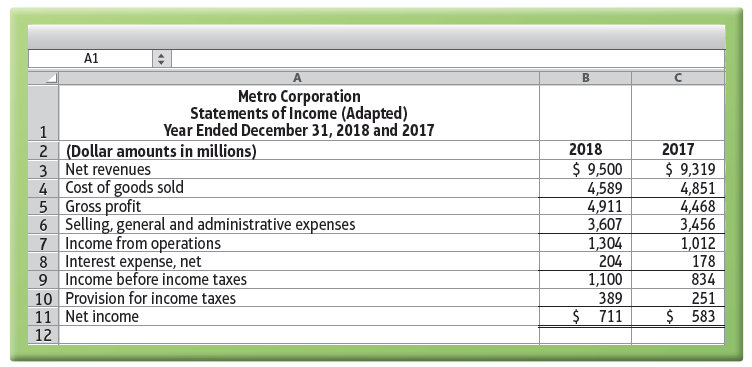

Data from S12-7

The Metro 2018 income statement follows.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: