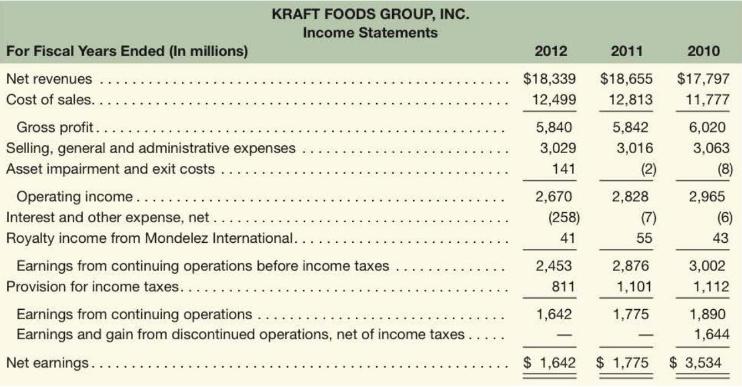

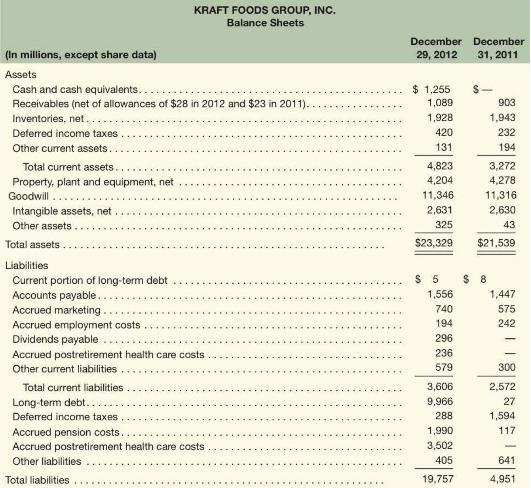

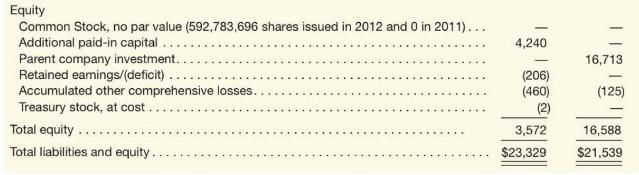

Balance sheets and income statements for Kraft Foods Group, Inc, follow. Refer to these financial statements to

Question:

Balance sheets and income statements for Kraft Foods Group, Inc, follow. Refer to these financial statements to answer the following requirements.

Required

a. Compute net operating profit after tax (NOPAT) for 2012. Assume that the combined federal and state statutory tax rate is \(37 \%\).

b. Compute net operating assets (NOA) for 2012 and 2011.

c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2012; confirm that RNOA = NOPM \(\times\) NOAT. The median NOPM and NOAT for companies in the packaged food industry (see Exhibit 4.4) is 5\% and 2.1, respectively, yielding a median RNOA of \(10.5 \%\). Comment on NOPM and NOAT estimates for KFT in comparison to industry medians.

d. Compute net nonoperating obligations (NNO) for 2012 and 2011. Confirm the relation: NOA \(=\) NNO + Stockholders' equity.

e. Compute return on equity (ROE) for 2012.

\(f\). Infer the nonoperating return component of ROE for 2012.

g. Comment on the difference between ROE and RNOA. What does this relation suggest about Kraft's use of debt?

Kraft Foods Group, Inc. (KFT)

Abbott Laboratories (ABT) FedEx Corp. (FDX) CVS Caremark Corp. (CVS) Kraft Foods Group, Inc. (KFT) Walgreen Co. (WAG) Caterpillar, Inc. (CAT) Target Corp. (TGT)

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton