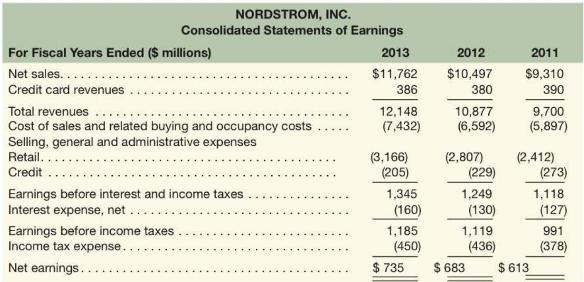

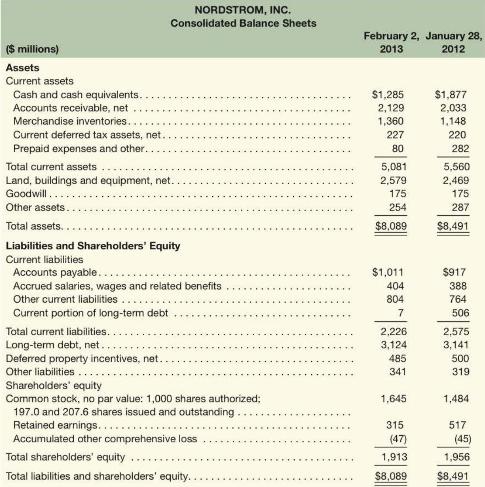

Balance sheets and income statements for Nordstrom, Inc., follow. Refer to these financial statements to answer the

Question:

Balance sheets and income statements for Nordstrom, Inc., follow. Refer to these financial statements to answer the requirements.

Required

a. Compute net operating profit after tax (NOPAT) for 2013. Assume that the combined federal and state statutory tax rate is \(37 \%\).

b. Compute net operating assets (NOA) for 2013 and 2012.

c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2013; confirm that RNOA \(=\) NOPM \(\times\) NOAT. Comment on NOPM and NOAT estimates for Nordstrom in comparison to the ratios for Walmart calculated earlier in the module.

d. Compute net nonoperating obligations (NNO) for 2013 and 2012. Confirm the relation: \(\mathrm{NOA}=\) NNO + Stockholders' equity.

e. Compute return on equity (ROE) for 2013.

\(f\). Infer the nonoperating return component of ROE for 2013.

g. Comment on the difference between ROE and RNOA. What does this relation suggest about Nordstrom's use of equity capital?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton