Cummins Inc. (CMI) reports investments in affiliated companies, consisting mainly of investments in nine manufacturing joint ventures.

Question:

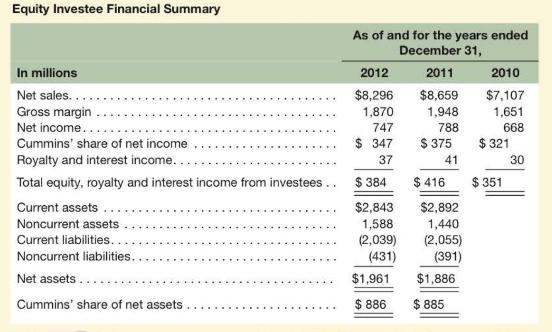

Cummins Inc. (CMI) reports investments in affiliated companies, consisting mainly of investments in nine manufacturing joint ventures. Cummins reports those investments on its balance sheet at \(\$ 886\) million, and provides the following financial information of its investee companies in a footnote to its \(10-\mathrm{K}\) report:

a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins' balance sheet as a result of the equity method of accounting for those investments?

b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain.

c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset turnover and net operating profit margin)?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton