Buck Novak, the chief executive officer of Novak Corporation, has assembled his top advisers to evaluate an

Question:

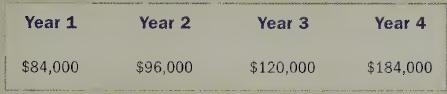

Buck Novak, the chief executive officer of Novak Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay \($400,000\) cash at the beginning of the investment and the cash inflow for each of the following four years to be the following.

Mr. Novak agrees with his advisers that the company should use the discount rate (required rate of return) of 12 percent to compute net present value to evaluate the viability of the proposed project.

Required

a. Compute the net present value of the proposed project. Should Mr. Novak approve the project?

b. Lydia Hollman, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible. The depreciation is expected to be \($80,000\) per year for the four-year period. The com¬ pany’s income tax rate is 30 percent per year. Use this information to revise the company’s expected cash flow from this project.

c. Compute the net present value of the project based on the revised cash flow forecast. Should Mr. Novak approve the project?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay