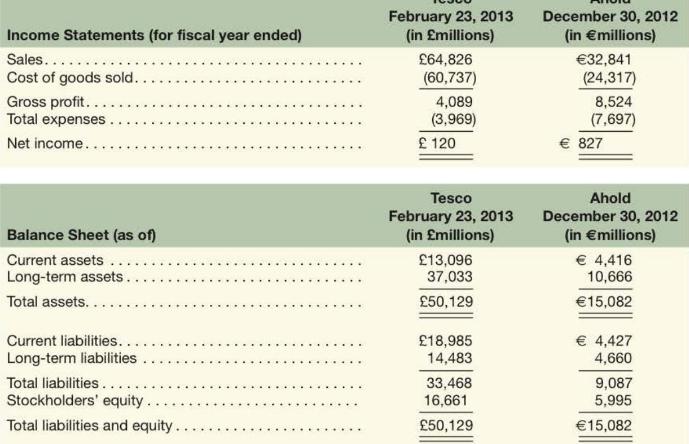

Following are selected income statement and balance sheet data from two European grocery chain companies: Tesco PLC

Question:

Following are selected income statement and balance sheet data from two European grocery chain companies: Tesco PLC (UK) and Ahold (The Netherlands).

Required

a. Prepare a common-sized income statement. To do this, express each income statement amount as a percent of sales. Comment on any differences observed between the two companies. Ahold's gross profit percentage of sales is considerably higher than Tesco's. What might explain this difference?

b. Prepare a common-sized balance sheet. To do this, express each balance sheet amount as a percent of total assets. Comment on any differences observed between the two companies.

c. Ahold has chosen to structure itself with a higher proportion of equity (and a lower proportion of debt) than Tesco. How does this capital structure decision affect your assessment of the relative riskiness of these two companies?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton