Question:

Headquartered in London in the United Kingdom, BAE Systems is a global defense, aerospace and security company employing around 88,200 people worldwide. The company's wide-ranging products and services cover air, land and naval forces, as well as advanced electronics, security, information technology, and support services. BAE Systems is the worlds̀ third largest defense and aerospace company based on revenues. The company uses IFRS for its financial statements, which include the following notes:

Required

a. Under IFRS, what six criteria did BAE Systems have to meet in order to capitalize development costs?

b. What was the common-sized research and development expense each year? The company recorded sales revenue of \(£ 17,834\) and \(£ 19,154\) in 2012 and 2011 respectively.

c. Assume that during 2012, the company capitalized \(£ 432\) of additional development expenditures and amortized \(£ 229\) of previously capitalized costs. Determine what the R\&D expense would have been under U.S. GAAP.

Transcribed Image Text:

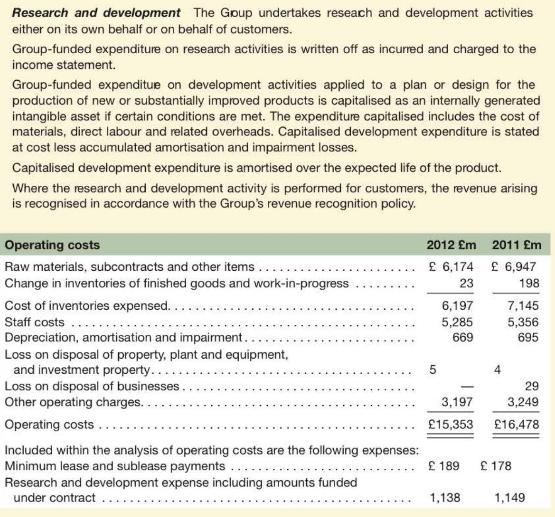

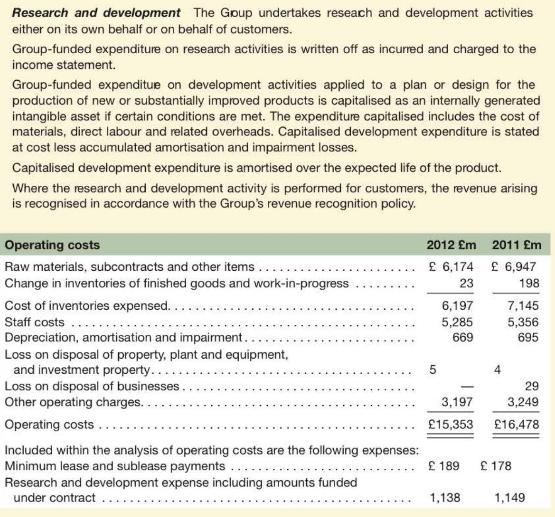

Research and development The Group undertakes reseach and development activities either on its own behalf or on behalf of customers. Group-funded expenditure on research activities is written off as incurred and charged to the income statement. Group-funded expenditue on development activities applied to a plan or design for the production of new or substantially improved products is capitalised as an internally generated intangible asset if certain conditions are met. The expenditure capitalised includes the cost of materials, direct labour and related overheads. Capitalised development expenditure is stated at cost less accumulated amortisation and impairment losses. Capitalised development expenditure is amortised over the expected life of the product. Where the research and development activity is performed for customers, the revenue arising is recognised in accordance with the Group's revenue recognition policy. Operating costs Raw materials, subcontracts and other items Change in inventories of finished goods and work-in-progress Cost of inventories expensed... Staff costs.... Depreciation, amortisation and impairment.. Loss on disposal of property, plant and equipment, and investment property.... Loss on disposal of businesses. Other operating charges... Operating costs... Included within the analysis of operating costs are the following expenses: Minimum lease and sublease payments ... Research and development expense including amounts funded under contract 2012 m 6,174 23 5 6,197 5,285 669 3,197 15,353 2011 m 6,947 198 1,138 7,145 5,356 695 29 3,249 16,478 189 178 1,149