Interpreting and Applying Disclosures on Property and Equipment (LO3) Following are selected disclosures from the Rohm and

Question:

Interpreting and Applying Disclosures on Property and Equipment (LO3)

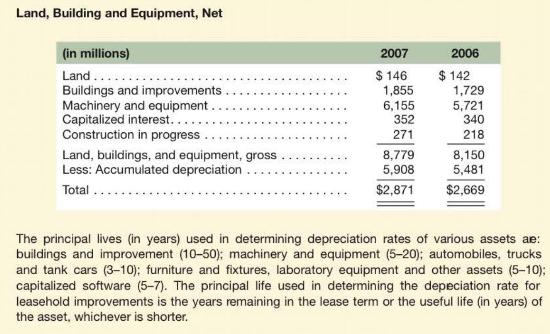

Following are selected disclosures from the Rohm and Haas Company (a specialty chemical company) 2007 10-K.

Required

a. Compute the PPE turnover for 2007 (Sales in 2007 are \(\$ 8,897\) million). Does the level of its PPE turnover suggest that Rohm and Haas is capital intensive? Explain. (Hint: The median PPE turnover for all publicly traded companies is approximately 5.03 in 2007.)

b. Rohm and Haas reported depreciation expense of \$412 million in 2007. Estimate the useful life, on average, for its depreciable PPE assets.

c. By what percentage are Rohm and Haas' assets "used up" at year-end 2007? What implication does the assets used up computation have for forecasting cash flows?

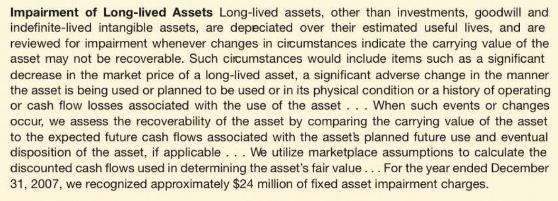

d. Rohm and Haas reports an asset impairment charge in 2007. How do companies determine if assets are impaired? How do asset impairment charges affect Rohm and Haas' cash flows for 2007? How would we treat these charges for analysis purposes?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton