Answered step by step

Verified Expert Solution

Question

1 Approved Answer

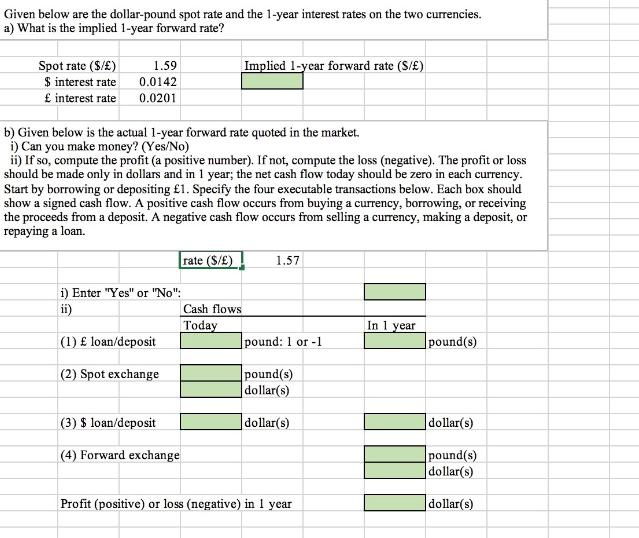

Given below are the dollar-pound spot rate and the 1-year interest rates on the two currencies. a) What is the implied 1-year forward rate?

Given below are the dollar-pound spot rate and the 1-year interest rates on the two currencies. a) What is the implied 1-year forward rate? Spot rate ($/) 1.59 $ interest rate 0.0142 interest rate 0.0201 Implied 1-year forward rate (S/) b) Given below is the actual 1-year forward rate quoted in the market. i) Can you make money? (Yes/No) ii) If so, compute the profit (a positive number). If not, compute the loss (negative). The profit or loss should be made only in dollars and in 1 year; the net cash flow today should be zero in each currency. Start by borrowing or depositing 1. Specify the four executable transactions below. Each box should show a signed cash flow. A positive cash flow occurs from buying a currency, borrowing, or receiving the proceeds from a deposit. A negative cash flow occurs from selling a currency, making a deposit, or repaying a loan. i) Enter "Yes" or "No": rate (S/) 1.57 ii) Cash flows Today In 1 year (1) loan/deposit pound: 1 or -1 pound(s) (2) Spot exchange pound(s) dollar(s) (3) $ loan/deposit dollar(s) dollar(s) (4) Forward exchange pound(s) dollar(s) Profit (positive) or loss (negative) in 1 year dollar(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the implied 1year forward rate we can use the interest rate parity formula Implied 1y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started