Project 1 requires an original investment of $375,000. The project will yield cash flows of $90,000 per

Question:

Project 1 requires an original investment of $375,000. The project will yield cash flows of $90,000 per year for 8 years. Project 2 has a computed net present value of $50,000 over a 6-year life. Project 1 could be sold at the end of 6 years for a price of $40,000.

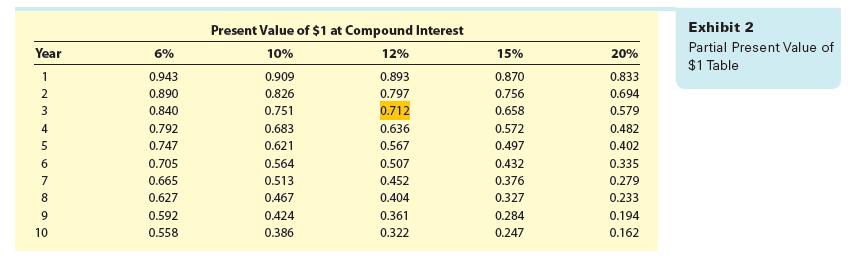

(a) Using the present value tables in Exhibits 2 and 5, determine the net present value of Project 1 over a 6-year life, with residual value, assuming a minimum rate of return of 10%.

(b) Which project provides the greatest net present value?

Exhibits 2

Exhibits 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting

ISBN: 9780357714041

16th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William Tayler

Question Posted: