YUM! Brands, Inc., discloses the following pension footnote in its (10-mathrm{K}) report. a. Explain the terms service

Question:

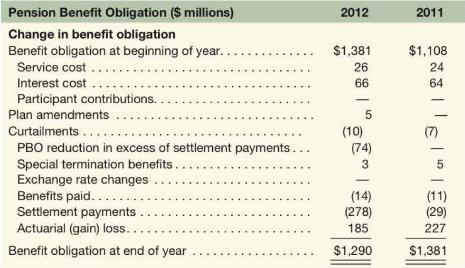

YUM! Brands, Inc., discloses the following pension footnote in its \(10-\mathrm{K}\) report.

a. Explain the terms "service cost" and "interest cost."

b. How do actuarial losses arise?

c. The fair value of YUM!'s pension assets is \(\$ 945\) million as of 2012 . What is the funded status of the plan, and how will this be reflected on YUM!'s balance sheet?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: