During the month of June, John Trent organized and began to operate an air taxi service to

Question:

During the month of June, John Trent organized and began to operate an air taxi service to provide air transportation from a major city to a number of small towns not served by scheduled airlines. Transactions during the month of June were as follows: LO8 June 1 John Trent deposited $480,000 cash in a bank account in the name of the business, Trent Air Service.

June 2 Purchased an aircraft for $356,400 and spare parts for $42,000, paying cash.

June 4 Paid $540 cash to rent a building for June.

June 10 Cash receipts from passenger fares revenue for the first 10 days amounted to $10,320.

June 14 Paid $750 to Motor Maintenance Service for maintenance and repair serv¬

ice for June.

June 15 Paid $2,880 salaries to employees for services rendered during first half of June.

June 20 Cash receipts from passenger fares revenue for the second 10 days amounted to $12,250.

June 30 Cash receipts from passenger fares revenue for the last 10 days of June amounted to $20,000.

June 30 Paid $3,000 salaries to employees for services rendered during the second half of June.

June 30 Trent withdrew $2,000 from business for personal use.

June 30 Received a fuel bill from Phillips Oil Company amounting to $4,548 to be paid before July 10.

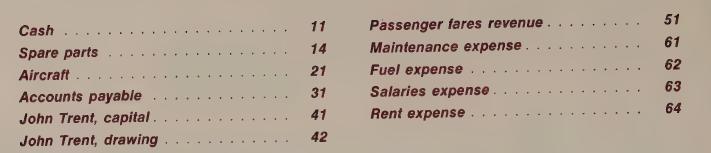

The account titles and numbers used by Trent Air Service are as follows:

Instructions Based on the foregoing transactions a Prepare journal entries. (Number journal pages to permit cross reference to ledger )

b Post to ledger accounts. (Number ledger accounts to permit cross reference to journal.) Enter ledger account numbers in the LP column of the journal as the posting work is done.

c Prepare a trial balance at June 30, 19 -

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs