Plaza Parking System was organized on March 1 for the purpose of operating an automobile parking lot.

Question:

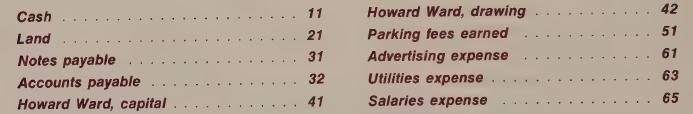

Plaza Parking System was organized on March 1 for the purpose of operating an automobile parking lot. Included in the company’s ledger are the following ledger accounts and their identification numbers. LO8

The business was organized and operations were begun during the month of March.

Transactions during March were as follows:

Mar. 1 Howard Ward deposited $102,000 cash in a bank account in the name of the business, the Plaza Parking System.

Mar. 2 Purchased land for $90,000, of which $54,000 was paid in cash. A short-term note payable (without interest) was issued for the balance of $36,000.

Mar. 2 An arrangement was made with the Century Club to provide parking privi¬

leges for its customers. Century Club agreed to pay $660 monthly, payable in advance. Cash was collected for the month of March.

Mar. 7 Arranged with Times Printing Company for a regular advertisement in the Times at a monthly cost of $114. Paid for advertising during March by check, $114.

Mar. 15 Parking receipts for the first half of the month were $1,836, exclusive of the monthly fee from Century Club.

Mar. 31 Received bill for light and power from Pacific Power Company in the amount of $78, to be paid before April 10.

Mar. 31 Paid $720 to the parking attendant for services rendered during the month.

(Payroll taxes are to be ignored.)

Mar. 31 Parking receipts for the second half of the month amounted to $1,682.

Mar. 31 Ward withdrew $1,080 for personal use.

Mar. 31 Paid $12,000 cash on the note payable incurred with the purchase of land.

Instructions a Journalize the March transactions.

b Post to ledger accounts. Enter ledger account numbers in the LP column of the journal as the posting work is done, c Prepare a trial balance at March 31.

d Prepare an income statement and a balance sheet in report form. In the owner’s equity section of the balance sheet, show the changes in the owner’s capital during the period, as illustrated on page 103.

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs