John Marshall is employed as a bank loan officer for First State Bank. He is comparing two

Question:

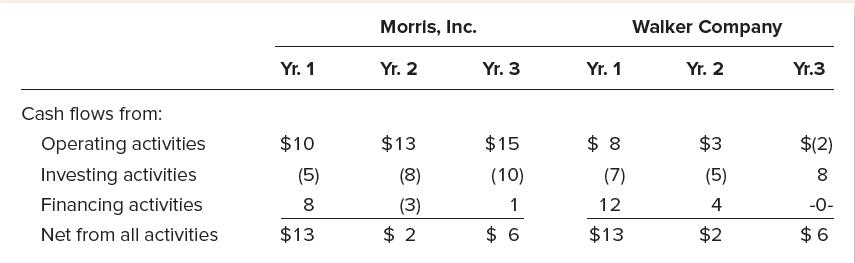

John Marshall is employed as a bank loan officer for First State Bank. He is comparing two companies that have applied for loans, and he requests your help in evaluating those companies. The two companies—Morris, Inc., and Walker Company—are approximately the same size and had approximately the same cash balance at the beginning of year 1. Because the total cash flows for the three-year period are virtually the same, John is inclined to evaluate the two companies as equal in terms of their desirability as loan candidates. Abbreviated information (in thousands of dollars) from Morris, Inc., and Walker Company is as follows.

Instructions

a. Do you agree with John’s preliminary assessment that the two companies are approximately equal in terms of their strength as loan candidates? Why or why not?

b. What might account for the fact that Walker Company’s cash flow from financing activities is zero in year 3?

c. Generally, what would you advise John with regard to using statements of cash flows in evaluating loan candidates?

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello