On October 1 Jon Linden, a licensed real estate broker, decided to organize a busi ness, to

Question:

On October 1 Jon Linden, a licensed real estate broker, decided to organize a busi¬

ness, to be known as Linden Realty. The following events occurred during October.

Oct. 1 Jon Linden opened a bank account in the name of the business by deposit¬

ing personal savings of $60,000. .

Oct. 2 Purchased land and a small office building at a total price of $126,000. 1 be terms of purchase required a cash payment of $46,000 and the issuance of a note payable for $80,000. The records of the property tax assessor indicated that the value of the building was one-half that of the land.

Oct. 4 Sold a portion of the land at cost of $10,500 to an adjacent business, Com¬

munity Medical Clinic, which wished to enlarge its parking lot. No down payment was required. Terms of the sale called for receipt of $2,000 within 10 days and the balance within 30 days.

Oct. 10 Purchased office equipment on credit from Swingline Company in the amount of $2,100.

Oct. 14 Received cash of $2,000 as partial collection of the receivable from Commu¬

nity Medical Clinic.

Oct. 19 Paid $1,200 as partial settlement of the liability to Swingline Company.

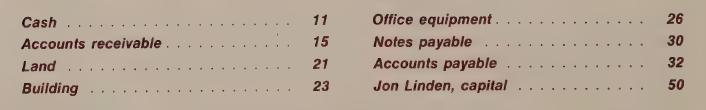

The account titles and account numbers to be used are:

Instructions a Prepare journal entries for the month of October, b Post to ledger accounts of the three-column running balance type, c Prepare a trial balance at October 31.

Step by Step Answer:

Accounting The Basis For Business Decisions

ISBN: 9780070415515

5th Edition

Authors: Robert F. Meigs, Walter B Meigs