Question:

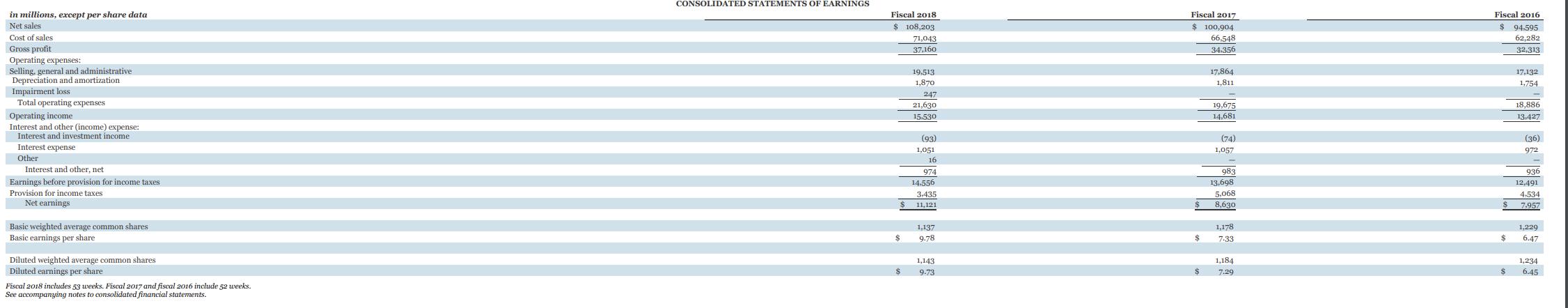

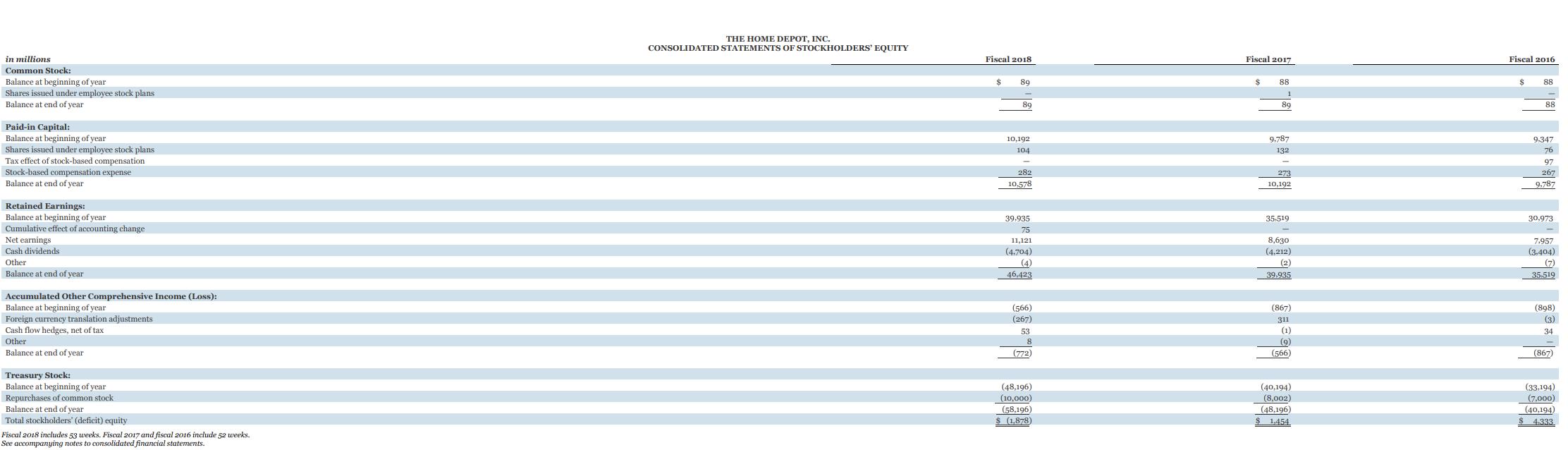

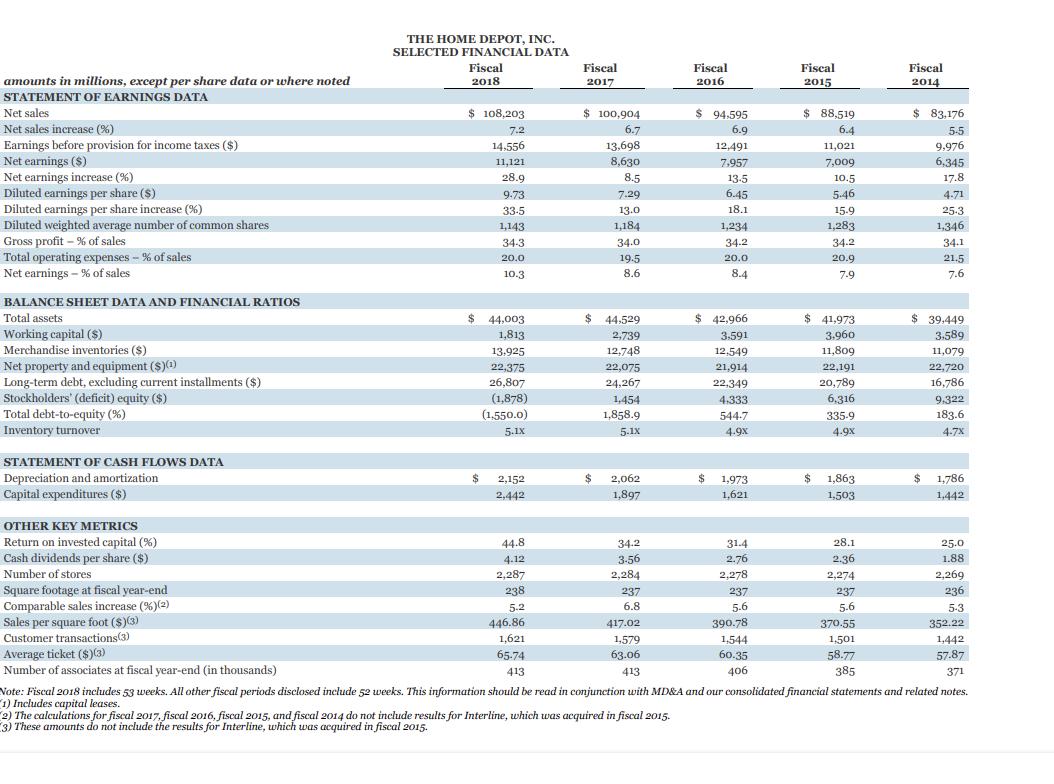

The Home Depot, Inc., financial statements appear in Appendix A at the end of this text. Use these statements to answer the following questions.

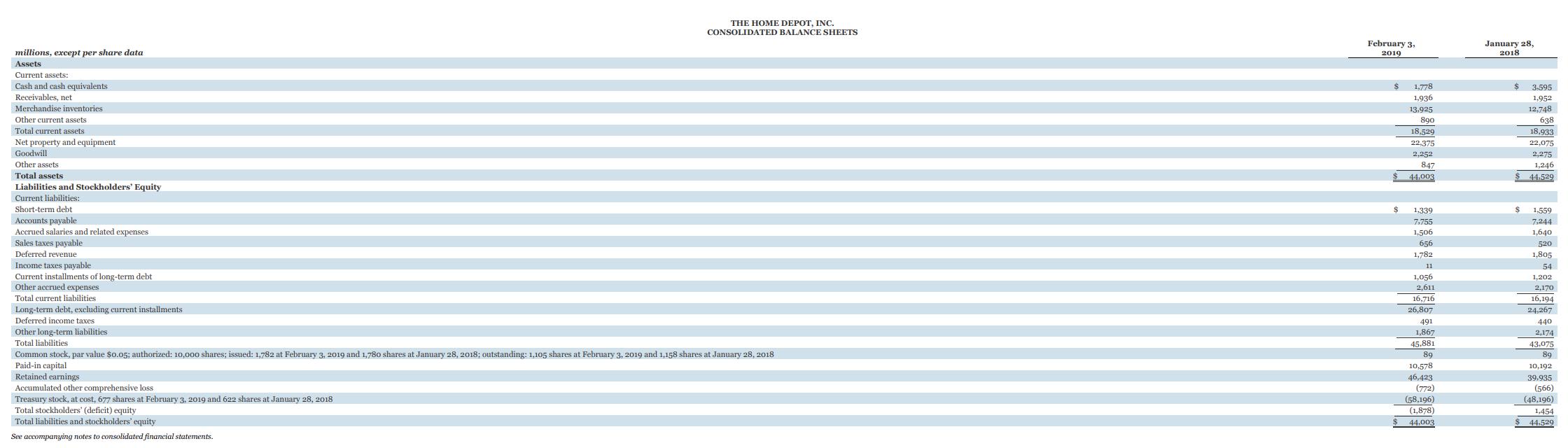

a. What is the total dollar value of the company’s current assets for the most current year reported? Has that amount increased or decreased in the most current year? How is the change in current assets impacted by the change in cash and cash equivalents?

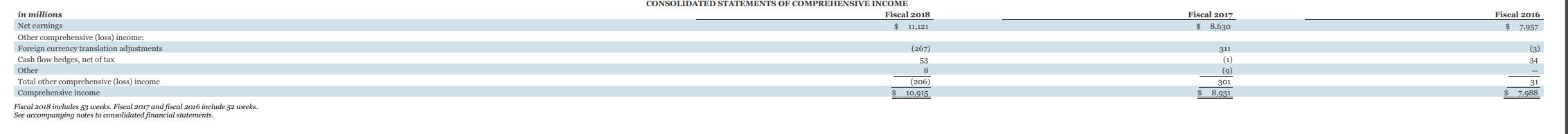

b. Does the company report any investments in marketable securities? If so, how does it report unrealized gains and losses?

c. Home Depot has several types of receivables which are combined which into a single receivables amount in the balance sheet. Which type of receivables comprises the largest portion of total receivables?

The Home Depot, Inc.

Transcribed Image Text:

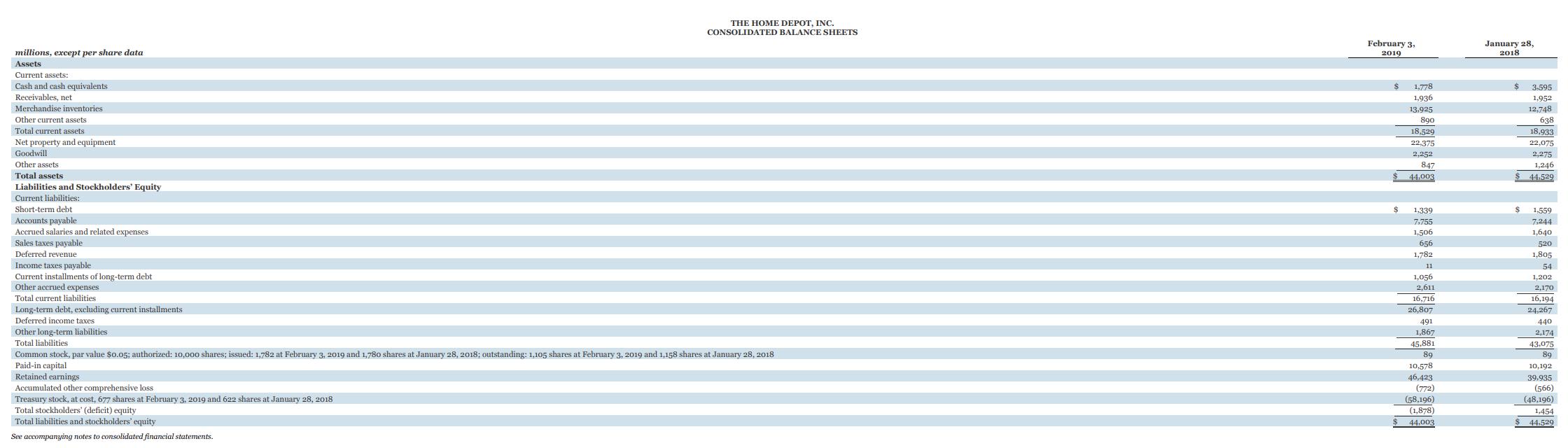

millions, except per share data

Assets

Current assets:

Cash and cash equivalents

Dow

Receivables, net

Mana

Merchandise inventories

ONL

Other current assets.

Total current assets

www

Net property and equipment.

Go

Goodwill

Other assets

Total assets

Tiabilition

Liabilities and Stockholders' Equity

Current liabilities:

Short-term debt

Accounts payable

Accrued salaries and related expenses

Autruc

mares

Sales taxes payable

Deferred revenue

Income taxes payable

ancong

Current installments of long-term debt

Othon noomsed

Other accrued expenses

Total current liabilities

THE HOME DEPOT, INC.

CONSOLIDATED BALANCE SHEETS

Long-term debt, excluding current installments

Deferred income taxes

Other long-term liabilities

Total liabilities

Total mitte

Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,782 at February 3, 2019 and 1,780 shares at January 28, 2018; outstanding: 1,105 shares at February 3, 2019 and 1,158 shares at January 28, 2018

Paid-in capital

Retained earnings

Accumulated other comprehensive loss

Treasury stock, at cost, 677 shares at February 3, 2019 and 622 shares at January 28, 2018

Total stockholders' (deficit) equity

Total liabilities and stockholders' equity

See accompanying notes to consolidated financial statements.

February 3,

2019

$

1,778

1,936

13,925

890

18,529

22,375

2,252

847

44,003

$ 1,339

7,755

1,506

656

1,782

11

$

1,056

2,611

16,716

26,807

C

491

1,867

45,881

M

89

10,578

10,5/0

46,423

40,423

(772)

(58,196)

(1,878)

44,003

January 28,

2018

$

$

3,595

1,952

12,748

638

18,933

22,075

2,275

1,246

44.529

1,559

7,244

1,640

520

1,805

54

B

1,202

2. 170

2,170

16.104

16,194

24,267

P

440

2,174

2,174

43,075

89

10,192

39,935

(566)

(48,196)

1,454

44,529