Crafty Tools manufactures an electric motor that it uses in several of its products. Management is Make

Question:

Crafty Tools manufactures an electric motor that it uses in several of its products. Management is

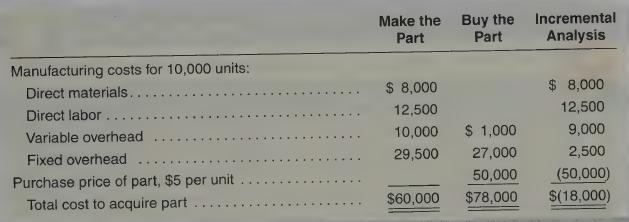

Make or Buy Decision

1. The company needs 10,000 motors per year. The motors can be purchased from an outside considering whether to continue manufacturing the motors or to buy them from an outside source. The following information is available: supplier at a cost of \(\$ 20\) per unit.

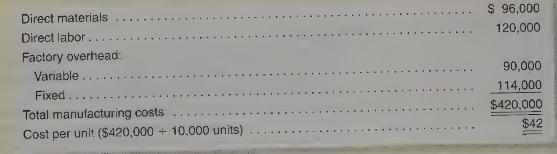

2. The unit cost of manufacturing the motors is \(\$ 42\), computed as follows:

3. Discontinuing the manufacture of motors will eliminate all the raw materials and direct labor costs but will eliminate only 75 percent of the variable factory overhead costs.

4. If the motors are purchased from an outside source, machinery used in the production of motors will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale

of this machinery would also eliminate \(\$ 4,000\) in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of motors.

Instructions

a. Prepare a schedule in the format illustrated in Exhibit 21-5 to determine the incremental cost or benefit of buying the motors from the outside supplier. Based on this schedule, would you recommend that the company manufacture the motors or buy them from the outside source?

Data from Exhibit 21-5

b. Assume that if the motors are purchased from the outside source, the factory space previously used to produce motors can be used to manufacture an additional 7,000 power trimmers per year. Power trimmers have an estimated contribution margin of \(\$ 10\) per unit. The manufacture of the additional power trimmers would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the motors? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the motors from the outside source and using the factory space to produce additional power trimmers.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 12

14th International Edition

Authors: Jan R. Williams, Joseph V. Carcello, Mark S. Bettner, Sue Haka, Susan F. Haka