Kathy Siska earned a salary of $400 for the last week of September. She will be paid

Question:

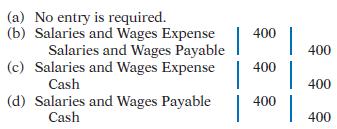

Kathy Siska earned a salary of $400 for the last week of September. She will be paid on October 1. The adjusting entry for Kathy’s employer at September 30 is:

Transcribed Image Text:

(a) No entry is required. (b) Salaries and Wages Expense Salaries and Wages Payable (c) Salaries and Wages Expense Cash (d) Salaries and Wages Payable Cash 400 | | | 400 400 400 400 400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Vineet Kumar Yadav

I am a biotech engineer and cleared jee exam 2 times and also i am a math tutor. topper comunity , chegg India, vedantu doubt expert( solving doubt for iit jee student on the online doubt solving app in live chat with student)

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 9780471980193

8th Edition

Authors: Jerry J Weygandt, Donald E Kieso, Paul D Kimmel

Question Posted:

Students also viewed these Business questions

-

The Arsenio is moving from Ontario to Alberta for work. He purchased a one-way plane ticket for $440. The distance from his old residence (in Ontario) to his new residence (in Alberta) is 3,300 km....

-

Why is the provisional tax rate different in different provinces ? what attributes or factors are taken in consideration? Who decides the tax rates of province?

-

Anika Wilson earned a salary of $400 for the last week of September. She will be paid on October 1. The adjusting entry for Anikas employer at September 30 is: (a) No entry is required. (b) Salaries...

-

May-22 1 1 1 6 22 31 31 31 31 31 uChampion (UC) Shop commenced business on 1 May 2022. The following transactions occurred during the first month of operations: Jenny, the owner, invested cash into...

-

A 1 - 1 - in sleeve bearing supports a load of 700 lbf and has a journal speed of 3600 rev/min. An SAE 10 oil is used having an average temperature of 160F. Using Fig. 1216, estimate the radial...

-

Standardized measures seem to indicate that the average level of anxiety has increased gradually over the past 50 years (Twenge, 2000). In the 1950s, the average score on the Child Manifest Anxiety...

-

Which of the following is not a selling overhead? (a) Royalty on sales (b) Distribution of samples (c) Legal cost for debt realization (d) Insurance to cover sold goods while in transit

-

Calculating Total Cash Flows Given the information for Marias Tennis Shop, Inc., in Problems 11 and 12, suppose you also know that the firms net capital spending for 2007 was $760,000, and that the...

-

Question Completion Status: QUESTION 22 George sells his car to Agnes for $8,000 cash and Agnes assuming George's car loan of $9,000. George's adjusted basis in the car at the time of sale was 15000...

-

The trial balance shows Supplies $0 and Supplies Expense $1,500. If $800 of supplies are on hand at the end of the period, the adjusting entry is: (a) Debit Supplies $800 and credit Supplies Expense...

-

Queenan Company computes depreciation on delivery equipment at $1,000 for the month of June. The adjusting entry to record this depreciation is as follows. (a) Depreciation Expense Accumulated...

-

Shea Savings negotiates a fixed-for-floating swap with a reputable firm in South America that has an exceptional credit rating. Shea is very confident that there will not be a default on inflow...

-

Cauchy's sequence theorem

-

QUESTION: 1 Discuss Local Government and Administration of Tanzania

-

Discuss how Central Governments Exercise Control over Local Governments by Citing Examples

-

Find derivative of sin x,cos a,tan x,secx,csca, cot a

-

Find anti derivative of cos x,sin x,sec r,sec r tan r,csc xcotx,csc r

-

(a) Railroad curve with Dc = 400(, I = 2400(, and PI station = 36 + 45.00 ft. (b) Highway curve with Da = 240(, I = 1420(, and PI station = 24 + 65.00 ft. (c) Highway curve with R = 500.000 m, I =...

-

The words without recourse on an indorsement means the indorser is: a. not liable for any problems associated with the instrument. b. not liable if the instrument is dishonored. c. liable personally...

-

The productions supervisor of the Machining department for Cramer Company agreed to the following monthly static budget for the up coming year: Cramer Company Machining Department Monthly Production...

-

Steelcase Inc. is one of the largest manufactures of office furniture in the United States. In Grand Rapids, Michigan, it produces filing cabinets in two departments: Fabrication and Trim Assembly....

-

Rite Weight, Inc. produces a small and large version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: The finished goods inventory estimated...

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

-

firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8. Using...

Study smarter with the SolutionInn App