On January 22, 2007, Dome, Inc., sold 700 toner cartridges to Maxine Supplies. Immediately prior to this

Question:

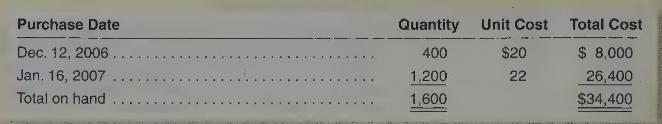

On January 22, 2007, Dome, Inc., sold 700 toner cartridges to Maxine Supplies. Immediately prior to this sale, Dome's perpetual inventory records for these units included the following cost layers:

Instructions

We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries. However, you may find it helpful to work part b first.

a. Prepare a separate journal entry to record the cost of goods sold relating to the January 22 sale of 700 toner cartridges, assuming that Dome uses:

1. Specific identification ( 300 of the units sold had been purchased on December 12 , and the remaining 400 had been purchased on January 16 ).

2. Average cost.

3. FIFO.

4. LIFO.

b. Complete a subsidiary ledger record for the toner cartridges using each of the four inventory valuation methods listed above. Your inventory records should show both purchases of this product, the sale on January 22, and the balance on hand at December 12, January 16, and January 22. Use the formats for inventory subsidiary records.

c. Refer to the cost of goods sold figures computed in part a. For financial reporting purposes, can the company use the valuation method that resulted in the highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold? Explain.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 12

14th International Edition

Authors: Jan R. Williams, Joseph V. Carcello, Mark S. Bettner, Sue Haka, Susan F. Haka