Toys R Us uses LIFO to account for its inventories. Recent financial statements were used to compile

Question:

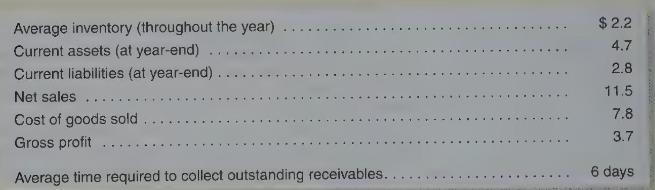

Toys "R" Us uses LIFO to account for its inventories. Recent financial statements were used to compile the following information (dollar figures are in billions):

Had Toys "R" Us used the FIFO inventory method, the following differences would have occurred:

1. Average inventory would have been \(\$ 2.8\) billion ( \(\$ 600\) million higher than the LIFO amount).

2. Ending inventory would have been \(\$ 2.7\) billion ( \(\$ 500\) million higher than the LIFO amount),

3. The cost of goods sold would have been \(\$ 7.3\) billion ( \(\$ 500\) million lower than the LIFO amount).

Instructions

a. Using the information provided, compute the following measures based upon the LIFO method:

1. Inventory turnover rate.

2. Current ratio.

3. Gross profit rate (see Chapter 6 for a discussion of this statistic).

b. Recompute your results from part a using the FIFO method.

c. Notice that the cost of goods sold is lower under FIFO than LIFO. What circumstances must the company have encountered to cause this situation? (Were replacement costs, on average, rising or falling?)

d. Explain why the average number of days required by Toys "R" Us to collect its accounts receivable is so low.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 12

14th International Edition

Authors: Jan R. Williams, Joseph V. Carcello, Mark S. Bettner, Sue Haka, Susan F. Haka