Selected accounts for Cate Photography at December 31, 2025, follow: Requirements 1. Journalize Cate Photographys closing entries

Question:

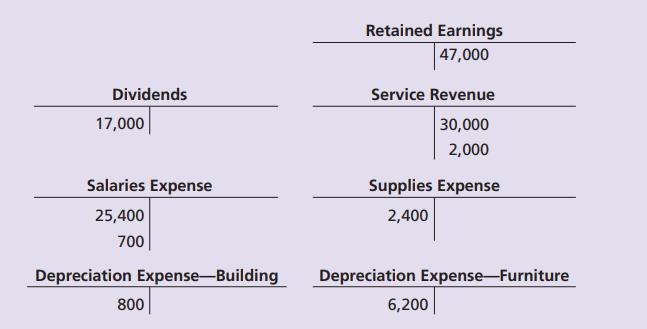

Selected accounts for Cate Photography at December 31, 2025, follow:

Requirements

1. Journalize Cate Photography’s closing entries at December 31, 2025.

2. Determine Cate Photography’s ending Retained Earnings balance at December 31, 2025.

Transcribed Image Text:

Dividends 17,000 Salaries Expense 25,400 700 Depreciation Expense-Building 800 Retained Earnings 47,000 Service Revenue 30,000 2,000 Supplies Expense 2,400 Depreciation Expense-Furniture 6,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

1To journalize Cate Photographys closing entries at December 31 2025 we need to transfer the balance...View the full answer

Answered By

Surendar Kumaradevan

I have worked with both teachers and students to offer specialized help with everything from grammar and vocabulary to challenging problem-solving in a range of academic disciplines. For each student's specific needs, I can offer explanations, examples, and practice tasks that will help them better understand complex ideas and develop their skills.

I employ a range of techniques and resources in my engaged, interesting tutoring sessions to keep students motivated and on task. I have the tools necessary to offer students the support and direction they require in order to achieve, whether they need assistance with their homework, test preparation, or simply want to hone their skills in a particular subject area.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

Selected accounts for Kebby Photography at December 31, 2018, follow: Requirements 1. Journalize Kebby Photography's closing entries at December 31, 2018. 2. Determine Kebby Photography's ending...

-

Selected accounts for Klein Photography at December 31, 2014 follow. Requirements 1. Journalize Klein Photographys closing entries at December 31, 2014. 2. Determine Klein Photographys ending...

-

The accountant for Klein Photography has posted adjusting entries (a)(e) to the following selected accounts at December 31, 2012. Requirements 1. Journalize Klein Photographys closing entries at...

-

P Corporation acquired an 80% interest in S Corporation two years ago at an implied value equal to the book value of S. On January 2, 2017, S sold equipment with a five-year remaining life to P for a...

-

Dons Captain Morgan, Inc. needs to raise $12.5 million to finance plant expansion. In discussions with its investment bank, Dons learns that the bankers recommend an offer price (or gross proceeds)...

-

On December 31, 2010, Price Company purchased a controlling interest in Shipley Company. The balance sheet of Price Company and the consolidated balance sheet on December 31, 2010, were as follows:...

-

Identify three different ways capital is transferred between savers and borrowers. AppendixLO1

-

Consider the following cash flow: Year Cash Flow 0...................................-$400 1...........................................0 2....................................+200...

-

Why do auditors care about prenumbering and gap detection?

-

Q1: (50 Mark) Given the following noise data, calculate LAeq, L10, L50,L90, Nc and Lap: Time(sec) SPL(dBA) 10 70 20 50 30 65 40 60 50 55 60 65 70 60 80 55 90 70 100 50

-

The adjusted trial balance of Primitivo Real Estate Appraisal at June 30, 2025, follows: Requirements 1. Prepare the companys income statement for the year ended June 30, 2025. 2. Prepare the...

-

Samantas Bowling Alleys adjusted trial balance as of December 31, 2025, is presented below: Requirements 1. Prepare the closing entries for Samantas Bowling Alley. 2. Prepare a post-closing trial...

-

In Figure P2-38 select a value for \(R_{\mathrm{X}}\) so that \(R_{\mathrm{EQ} 1}=\) \(73 \mathrm{k} \Omega\). Then find \(R_{\mathrm{EQ} 2}\) - 15 47 REQI 22 Ri 10 ww 15 REQ2

-

2. If w = x + y z + sint and x + y = t, find Iw dw Iw a. b. c. av z x, z aw Iw aw d. e. f. az at at y, t x, Z y, z

-

Global Training Solutions (GTS) was founded 40 years ago by an educator/consultant/trainer to provide training to business employees, consulting services to businesses and school systems, and...

-

Consider the following open-loop transfer function: K(s+2a) G(s)H(s)= where K,a>0 s(s-a) The frequency when the phase is -180 degrees is: rad/s The magnitude of the open loop transfer function when...

-

Complete Exhibit 5 (this should be cost per cup and in CA$, do not convert). The exhibit is missing a line for Milk & Sugar within factory overhead section EXHIBIT 5: COSTING CHART Direct Cost Coffee...

-

Why is the tension negative in the net force x-component? The tension points right, so shouldn't it be positive? I saw elsewhere that the equation has negative T. Why? Chrome File Edit View History...

-

Elgin Restaurant Supplies is analyzing the purchase a equipment that will cost $20,000. The annual cash inflows for the next three years will be: Year....................................Cash Flow...

-

Solve each problem. Find the coordinates of the points of intersection of the line y = 2 and the circle with center at (4, 5) and radius 4.

-

Marlies Inc. issued $1,500,000 of 6 percent, 10-year bonds payable and received cash proceeds of $1,393,407 on March 31, 2020. The market interest rate at the date of issuance was 7 percent, and the...

-

Journalize the following transactions of Fayuz Communications Inc.: 2020 Jan. 2 Issued $8,000,000 of 7 percent, 10-year bonds payable at 97.00. 2 Signed a five-year capital lease on machinery. The...

-

Silver Corp. has $156 million of bonds outstanding at December 31, 2020. Of the total, $26 million are due in 2021 and the balance in 2022 and beyond. How would Silver Corp. report its bonds payable...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

-

Regarding research and experimental expenditures, which of the following are not qualified expenditures? 3 a. costs of ordinary testing of materials b. costs to develop a plant process c. costs of...

Study smarter with the SolutionInn App