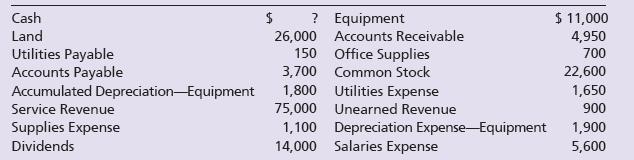

Seths Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have

Question:

Seth’s Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances.

Prepare the adjusted trial balance for Seth’s Tax Services as of December 31, 2024.

Transcribed Image Text:

Cash Land Utilities Payable Accounts Payable Accumulated Depreciation Equipment Service Revenue Supplies Expense Dividends $ ? 26,000 150 3,700 Equipment Accounts Receivable Office Supplies Common Stock 1,800 Utilities Expense 75,000 Unearned Revenue 1,100 Depreciation Expense-Equipment 14,000 Salaries Expense $ 11,000 4,950 700 22,600 1,650 900 1,900 5,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

Account Title Cash Accounts Receivable Office Supplies Land Equipment Accumulated Depreciati...View the full answer

Answered By

Krishnavendra Y

I am a self motivated financial professional knowledgeable in; preparation of financial reports, reconciling and managing accounts, maintaining cash flows, budgets, among other financial reports. I possess strong analytical skills with high attention to detail and accuracy. I am able to act quickly and effectively when dealing with challenging situations. I have the ability to form positive relationships with colleagues and I believe that team work is great key to performance. I always deliver quality, detailed, original (0% plagiarism), well-researched and critically analyzed papers.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura

Question Posted:

Students also viewed these Business questions

-

Scott Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances. Prepare the adjusted trial balance for Scott Tax Services as of...

-

Seth's Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances. Prepare the adjusted trial balance for Seth's Tax Services as of...

-

Walkers Tax Services had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances. Prepare the adjusted trial balance for Walkers Tax Services as...

-

In Exercises 6780, begin by graphing the square root function, f(x) = x. Then use transformations of this graph to graph the given function. h(x) = x + 1 1 Vx+1-1

-

Big Event Limited's sales, current assets, and current liabilities (all in thousands of dollars) have been reported over the past five years (year 5 is the most recent year): Required: 1. Express all...

-

What is a collaborative robot? What is an uncollaborative one?

-

6. If the current rate method is used, the gain or loss on translation is included under other comprehensive income. Explain why this makes sense economically.

-

Watershed is a media services company that provides online streaming movie and television content. As a result of the competitive market of streaming service providers, Watershed is interested in...

-

Can you answer all three? thank you Question 25 (10 points) If the market rate of a bond is greater than the stated rate, the bond is trading at a discount a) True b) False Question 26 (15 points)...

-

The unadjusted trial balance for All Mopped Up Company, a cleaning service, is as follows During the 12 months ended December 31, 2024, All Mopped Up: a. Used office supplies of $1,700. b. Used...

-

The unadjusted trial balance as of December 31, 2024, the end of the annual accounting period for Super Employment Services, follows Data needed for the adjusting entries include the following: a....

-

Would legalizing drugs reduce crime? Why or why not?

-

Your company has a Microsoft 365 E5 subscription. You need to review the Advanced Analysis tab on emails detected by Microsoft Defender for Office 365. What type of threat policy should you...

-

(a) The Bright company is evaluating a project which will cost Rs 1,00,000 and will have no salvage value at the end of its 5-year life. The project will save costs of Rs. 40,000 a year. The company...

-

Dispatcher Collins is retiring after 30 years on the job. If each of the 38 officers in the department contributes $9 for a retirement gift, what is the total amount that could be spent on this gift

-

XYZ CO Adjusted Trial Balance Debit Credit Cash Accounts receivable Office supplies Prepaid rent $ 40 850 1 490 1 530 4 000 Office equipment Accumulated Depreciation Accounts payable 7 000 $ 450 1...

-

What positive outcomes could result from implementing job enlargement, job rotation, and job enrichment in an organization with which you are familiar? What objections or obstacles might be...

-

When a major league baseball players contract has expired, he can either sign a new contract with his current team or become a free agent and sign a contract to play with a different team. If adverse...

-

Research an article from an online source, such as The Economist, Wall Street Journal, Journal of Economic Perspectives, American Journal of Agricultural Economics, or another academic journal. The...

-

In regard to a bond discount or premium, what is the effective-interest amortization method?

-

Patricks Delivery Services is buying a van to help with deliveries. The cost of the vehicle is $35,000, the interest rate is 6%, and the loan is for three years. The van is to be repaid in three...

-

The Walt Disney Company is a diversified entertainment company that is comprised of five different business segments. Walt Disney began as a cartoon studio in 1920 and today is known as a leading...

-

The company sold merchandise to a customer on March 31, 2020, for $100,000. The customer paid with a promissory note that has a term of 18 months and an annual interest rate of 9%. The companys...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

-

An investor wants to purchase a zero coupon bond from Timberlake Industries today. The bond will mature in exactly 5.00 years with a redemption value of $1,000. The investor wants a 12.00% annual...

Study smarter with the SolutionInn App