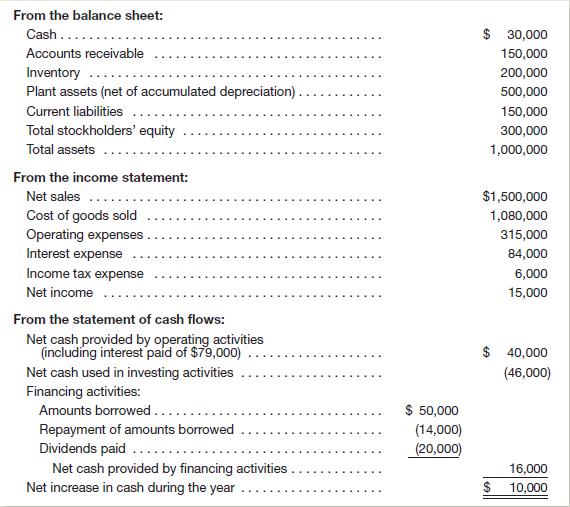

Shown below is selected information from the financial statements of Dickson, Inc., a retail furniture store. Instructions

Question:

Shown below is selected information from the financial statements of Dickson, Inc., a retail furniture store.

Instructions

a. Explain how the interest expense shown in the income statement could be $84,000, when the interest payment appearing in the statement of cash flows is only $79,000.

b. Compute the following (round to one decimal place):

1. Current ratio

2. Quick ratio

3. Working capital

4. Debt ratio

c. Comment on these measurements and evaluate Dickson, Inc.’s short-term debt-paying ability.

d. Compute the following ratios (assume that the year-end amounts of total assets and total stockholders’ equity also represent the average amounts throughout the year):

1. Return on assets

2. Return on equity

e. Comment on the company’s performance under these measurements. Explain why the return on assets and return on equity are so different.

f. Discuss (1) the apparent safety of long-term creditors’ claims and (2) the prospects for Dickson, Inc., continuing its dividend payments at the present level.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 12

14th International Edition

Authors: Jan R. Williams, Joseph V. Carcello, Mark S. Bettner, Sue Haka, Susan F. Haka